Devangshu Dutta

January 10, 2017

In this piece I’ll just focus on one aspect of technology – artificial intelligence or AI – that is likely to shape many aspects of the retail business and the consumer’s experience over the coming years.

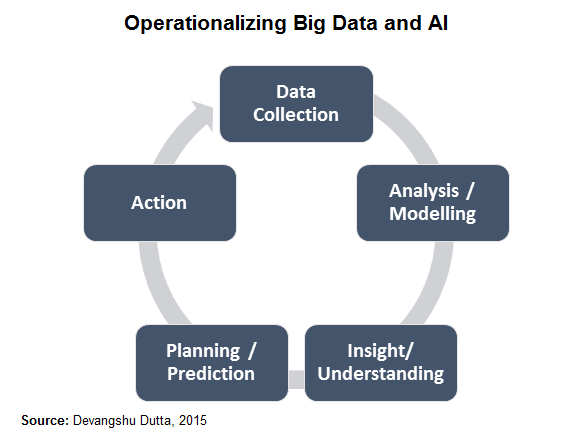

To be able to see the scope of its potential all-pervasive impact we need to go beyond our expectations of humanoid robots. We also need to understand that artificial intelligence works on a cycle of several mutually supportive elements that enable learning and adaptation. The terms “big data” and “analytics” have been bandied about a lot, but have had limited impact so far in the retail business because it usually only touches the first two, at most three, of the necessary elements.

“Big data” models still depend on individuals in the business taking decisions and acting based on what is recommended or suggested by the analytics outputs, and these tend to be weak links which break the learning-adaptation chain. Of course, each of these elements can also have AI built in, for refinement over time.

Certainly retailers with a digital (web or mobile) presence are in a better position to use and benefit from AI, but that is no excuse for others to “roll over and die”. I’ll list just a few aspects of the business already being impacted and others that are likely to be in the future.

On the consumer-side, AI can deliver a far higher degree of personalisation of the experience than has been feasible in the last few decades. While I’ve described different aspects, now see them as layers one built on the other, and imagine the shopping experience you might have as a consumer. If the scenario seems as if it might be from a sci-fi movie, just give it a few years. After all, moving staircases and remote viewing were also fantasy once.

On the business end it potentially offers both flexibility and efficiency, rather than one at the cost of the other. But we’ll have to tackle that area in a separate piece.

(Also published in the Business Standard.)

Tarang Gautam Saxena

October 30, 2011

The operating environment for the fashion retailers in India is only moving towards a more challenging and competitive direction even though the market is yet to mature. The market has grown over the last two decades on account of brand proliferation and developing retail network and more recently due to new product category creations. High consumer awareness and exposure to international trends has cut the product life cycles short. Topping this up, the last 12-18 months has witnessed the growth of the online platform offering an alternate, convenient and cost effective shopping option for consumers.

It is necessary that fashion retailers manage their operations efficiently both in terms of managing a complex and responsive supply chain at the back end and delighting the customers at the store with great product offers and customer service. Adopting lean practices can help fashion retailers to achieve significant improvements in store profitability and customer satisfaction, making their retail business sustainable through a positive impact on bottom-line.

The concept of lean philosophy, pioneered by Toyota, is built on the premise that inventory hides problems. The basic tenet of this philosophy is that keeping the inventory low will highlight the problems that can be dealt with and fixed immediately instead of maintaining inventory in anticipation of any bottlenecks.

“Lean retailing” is an emerging concept and has already been adopted by retail organisations in the Western countries using technology such as barcodes, RFID (across the product value chain from raw material sourcing through production through final delivery at the retail store) and item-level inventory management and network architectures.

In an ideal scenario a retail organization would be lean at both the store and the distribution center. The organization would leverage technology such as RFID to uniquely identify the movement of its inventory accurately and use fulfillment logic as per the store’s merchandizing principle to have replenishments in tune with customer demand.

Some international retailers that have adopted lean retailing techniques include Wal-Mart, Macy’s, Bloomingdale’s, The Gap and J. C. Penny. Applying lean philosophy to fashion retail in India may sound like an avante garde concept as of now. However, there are some leading large retailers in India such as the Future Group who are early adopters and have already adopted lean practices in their retail supply chain.

An understanding of what lean retailing is and some of its principles can help in appreciating how this concept can make the apparel retail business more sustainable. Lean retailing aims to continuously eliminate “waste” from the retail value chain, waste being defined as any activity/process that is not of “value” to the customer. A fundamental principle of lean retail is to identify customers and define the “value” as those elements of products or service that the customer believes he should be paying for, not necessarily those that add value to the product. Further the value should be delivered to the customer “first-time right every time” so that waste is minimized.

Lean retailing requires simplifying the workflow design in delivering products to customer. Given that the connotation of value is customer-centric, simplifying the workflow design requires streamlining the core and associated processes so that any kind of waste is eliminated. Further pull-system drives replenishment at the stores (and the shelf) based on what customers want “just-in-time” (neither before nor after the time customer demands). This results in a value flow as pulled by the customer.

Those practising lean retail have invested in information technology that allows the stores to share sales data in real time with their suppliers. New orders for a given product maybe automatically placed with the supplier as soon as an item is scanned at the check-out counter (subject to minimum order size criteria). Smaller stores may use visual systems wherein the sales staff can gauge through the empty shelf space the products that have been sold and that need to be re-ordered.

Removing bottlenecks throughout the supply chain is another principle driving lean retail. It entails redesigning processes to eliminate activities that prevent the free flow of products to the customer. Further, lean retail requires following a culture of continuous improvement. Continuous improvement (or “Kaizen”) focuses on small improvements across the value chain that rolls up into significant improvements at an overall level. Kaizens not only can lead to elimination of wasted effort, time, materials, and motion but also focus on bringing in innovations that lead to things being done faster, better, cheaper and easier. Involvement of staff at the lowest levels is very important in Kaizen activities and that means that companies must invest in training, up-skilling their talent pool in Lean Principles.

In the context of apparel retail business, lean retail can help in improving organisational responsiveness to customer needs, the speed with which the products are delivered to them and meet their expectations as per the latest trends. Systematic application of lean principles translates in increased throughput (Sales), with lower Work in Process (Investments) and as per customer requirements of Quality, Design, Trends and Time. Improved information visibility across the chain leads to reduced instances of out of stock and excess inventory at the same time, minimising inventory control costs and reducing shrinkage. At the front-end lean retail may lead to redesigned in-store processes and systems for consistency in frontline behaviors to provide standard customer experience.

With the focus on training and involvement of the workforce, Lean principles have resulted in improving employee satisfaction without increasing labour costs that in turn positively impacts revenues and profitability. Some retailers in the West have reported reducing their store labour costs by 10-20 percent, inventory costs by 10-30 percent, and costs associated with stock outs by 20-75 percent on account of lean retail.

In addition to top-line and bottom-line impact, lean retailing by enhancing the enthusiasm and motivation of the frontline staff creates distinctive shopping experiences for customers.

Inditex, the world’s largest clothing retailer with Zara as its flagship brand, has successfully achieved supply chain excellence following lean principles. It targets fashion conscious young women and is able to spot trends as they emerge and deliver new products to stores quickly thereby establishing its position as the leading fast fashion retailer. The product development processes is based on customer pull-system. Its design team reviews the sales and inventory reports on a daily basis to identify what is selling and what is not. Additionally, regular visits to the field provide insights into the customers’ perceptions that can never be captured in the sales and inventory reports. Critical information about customer feedback is widely shared by store managers, buyers, merchandisers, designers and the production team in an open plan office at the company’s headquarters. Frequent, real time discussions and interactions within the team help them to understand the market situation and identify trends and opportunities.

Further, Zara manufactures the products in small lots and many styles are typically not repeated. Style cues for replenishments are derived from real time customer demand. At the back end, Zara holds inventory of raw materials and unfinished goods with its supply partners which may be local or offshore manufacturers. Typically, the fashion merchandise is produced at the local manufacturing base and quickly delivered while the staple low-variation range is produced offshore at cheaper costs.

Following lean retail practices implies a higher stock turn and frequent replenishments by the suppliers based on real-time sales. Building and maintaining reliable and responsive suppliers through win-win partnerships, is imperative to realize the success of lean retail implementation as high stock turns and frequent replenishments involves the commitment and involvement of the entire supplier base.

Like in any transformational effort, change management plays a critical role in reaping the benefits of lean retail. The whole philosophy requires paradigm shift in attitudes, behaviors and mind sets of those involved upstream and downstream across the value chain. Training, communicating and inspiring the front end staff is thus an important aspect in the overall success and companies need to device a compelling vision that is shared by employees across functions and hierarchy across the entire chain.

Devangshu Dutta

July 22, 2011

The apparel retail sector worldwide thrives on change, on account of fashion as well as season.

In India, for most of the country, weather changes are less extreme, so seasonal change is not a major driver of changeover of wardrobe. Also, more modest incomes reduce the customer’s willingness to buy new clothes frequently.

We believe pricing remains a critical challenge and a barrier to growth. About 5 years ago, Third Eyesight had evaluated the pricing of various brands in the context of the average incomes of their stated target customer group. For a like-to-like comparison with average pricing in Europe, we came to the conclusion that branded merchandise in India should be priced 30-50% lower than it was currently. And this is true not just of international brands that are present in India, but Indian-based companies as well. (In fact, most international brands end up targeting a customer segment in India that is more premium than they would in their home markets.)

Of course, with growing incomes and increasing exposure to fashion trends promoted through various media, larger numbers of Indian consumers are opting to buy more, and more frequently as well. But one only has to look at the share of marked-down product, promotions and end-of-season sales to know that the Indian consumer, by and large, believes that the in-season product is overpriced.

Brands that overestimate the growth possibilities add to the problem by over-ordering – these unjustified expectations are littered across the stores at the end of each season, with big red “Sale” and “Discounted” signs. When it comes to a game of nerves, the Indian consumer has a far stronger ability to hold on to her wallet, than a brand’s ability to hold on to the price line. Most consumers are quite prepared to wait a few extra weeks, rather than buying the product as soon as it hits the shelf.

Part of the problem, at the brands’ end, could be some inflexible costs. The three big productivity issues, in my mind, are: real estate, people and advertising.

Indian retail real estate is definitely among the most expensive in the world, when viewed in the context of sales that can be expected per square foot. Similarly, sales per employee rupee could also be vastly better than they are currently. And lastly, many Indian apparel brands could possibly do better to reallocate at least part of their advertising budget to developing better product and training their sales staff; no amount of loud celebrity endorsement can compensate for disinterested automatons showing bad products at the store.

Technology can certainly be leveraged better at every step of the operation, from design through supply chain, from planogram and merchandise planning to post-sale analytics.

Also, some of the more “modern” operations are, unfortunately, modelled on business processes and merchandise calendars that are more suited to the western retail environment of the 1980s than on best-practice as needed in the Indian retail environment of 2011! The “organised” apparel brands are weighed down by too many reviews, too many batch processes, too little merchant entrepreneurship. There is far too much time and resource wasted at each stage. Decisions are deliberately bottle-necked, under the label of “organisation” and “process-orientation”. The excitement is taken out of fashion; products become “normalised”, safe, boring which the consumer doesn’t really want! Shipments get delayed, missing the peaks of the season. And added cost ends in a price which the customer doesn’t want to pay.

The Indian apparel industry certainly needs a transformation.

Whether this will happen through a rapid shakedown or a more gradual process over the next 10-15 years, whether it will be driven by large international multi-brand retailers when they are allowed to invest directly in the country or by domestic companies, I do believe the industry will see significant shifts in the coming years.

Devangshu Dutta

May 16, 2009

The world’s largest retailer earned bouquets as well as a few brickbats when it recently opened a Hispanic version of its large store format, named Supermercado de Walmart. The signs around the store are in Spanish as well as English, selling traditional Mexican national brands as well as traditional Hispanic food like tacos, tortas, aguas frescas, sopes, carnitas and barbacoa at the chain’s customary low prices.

The surprise, if any, was that this store was not in a city in Mexico but in Houston, Texas, USA.

Wal-Mart’s logic behind the format is that it would be more relevant to the heavily-Hispanic population in the catchment of the store in Houston, and that it was a natural evolution to what they had been doing for years.

However, some customers and observers do not agree. Quite a number of people are up in arms against this “pandering to immigrants”, which they see as a threat to the unity, homogeneity and identity of the United States of America. One internet commentator condemned this segregation with a rather unique view, saying that segregating customers like this was actually “racist” and belittled the Hispanic customers who live in that area.

We should probably wait for the dust to settle on this debate. Spanish-speaking customers may actually respond positively – or not – to this new format. Yes, some defensive or aggravated English-speaking customers may also boycott Wal-Mart over this move.

As for me, I believe that it is a good move for Wal-Mart to test how far customization can help their business and how finely they can tune their response to customer demands, because they will need all the learnings they can get to effectively tackle markets that are even more different around the world.

Of course, many retailers and marketers in a market such as India would be puzzled by all this fuss. After all, if a Chennai-based company opened stores in Maharashtra, it wouldn’t put up signs in Tamil, neither would a Punjab-based retailer expect its customers in Imphal to understand promotions in Punjabi. Fragmentation and customization is a fact of life to the Indian retailer.

Or is it really that clear?

In fact, India has its share of marketers who seem to think and plan mainly in upper income metropolitan-English, and this bias creeps in not only in the content and structure of promotions but also, unfortunately, influences the merchandise mix. Even while PowerPoint presentations are made about how diverse the country is, and how it is possibly more like many countries rolled into one, we often make use of cookie-cutters for designing our product plan, our marketing strategy and everything else that defines the retail store and the customer experience.

Now, before I am labelled unfair for making sweeping generalizations, let me also say that other than any such urban English bias, there are also another couple of reasons why a retailer may take a template-based or cookie-cutter approach to the market.

Firstly, if you’re launching a new retail chain, there is a need to derive efficiency by driving scale as quickly as possible. Repeating the product formula across locations allows a retailer to increase the impact of merchandising efforts in terms of additional margins due to volume margin terms and better negotiating power with the supplier. Also, the management effort is used in a much more focussed manner, lowering effective management costs.

Secondly, there is the need to demonstrate a consistent image across the entire footprint of the chain, and to appear to be a chain. Repeating the product and presentation formula reinforces the common image and branding.

However, the pertinent question is whether there is any point in following a consistent identity if it appears alien and irrelevant to most of your target customers? In a category such as grocery, where the customer don’t really shop across multiple stores in a chain, is it better to be locally relevant rather than consistent across the country or even a region? Clearly, if you have a national or international template that is locally irrelevant, you don’t have any chance of succeeding with the consumer.

On the other hand, is it really organisationally possible for a chain-store to be local, and if so how can it best strike the balance between chain-wide consistency and tweaking the offer to provide local focus?

To my mind the starting point is the definition of an identity based on a clear value proposition and operating principles. This includes a range of factors from the visual elements of branding to how the staff stack shelves or interact with the customer.

The next step is to make the merchandise locally relevant, because that is what creates the transaction. The answer to “how much local” would also provide the answer to “how the locally-relevant merchandise should be managed”. Organisational models could range from entirely centrally-managed local merchandise and data-driven decisions, to central management of range architecture and purchases but local pull-based replenishment, to outright purchase from local vendors by the specific store’s management to create a truly local store.

Of course, devolving range and purchase decisions to local management raises issues about maintaining control as well. To a certain extent processes and system can help to mitigate the risk of fragmentation of the identity or potential mismanagement.

But the strongest glue is culture, as the manifestation of the organisational identity. Culture defines most strongly “the way” the organisation works.

Imagine the business as an individual with a well-defined personality. In different cities that individual might speak different languages and dress in different clothes, but still express the same values.

With a well defined and well expressed organisational personality, localisation can occur without fear of corruption of the brand identity, consistency and controls. Then the chain-store can truly become a local store and part of the consumer’s life as it is.

The other choice, of course, is to wait for a significant part of the local consumer to adapt to your international or national template. Would you be prepared for that?

admin

October 11, 2008

Differentiation is the key to surviving and thriving in tough times. In the lifestyle products sector (apparel, footwear, home, etc.) a big difference is the product design itself.

More than ever, it is vital for Indian companies – brands, suppliers as well as retailers – to develop their own design and product development team, in the shortest time. The team, including designers, merchandisers, buyers, sourcing people, textile and apparel manufacturers – must sharpen their skills in reading the market trends and in developing new products that can make their brands or retail stores stand apart in the customer’s eyes.

To share its insights and experience, Third Eyesight is organizing an intensive workshop on Product Development and Forecasting (with an insight on Trends for Autumn/Winter 2009/2010). Click to REGISTER NOW.

The workshop will draw upon live experiences from the area of product development in the lifestyle and fashion sector, and will cover:

Past workshops have included top / senior managers from companies such as:

Discounted delegate fees start at just over Rs. 9,000.