admin

January 15, 2026

Sagar Malviya, ET Bureau

Mumbai, 15 January 2026

It’s mostly a tale of two halves for top western fashion labels in India after the runaway sales and retail expansion in the years soon after the pandemic.

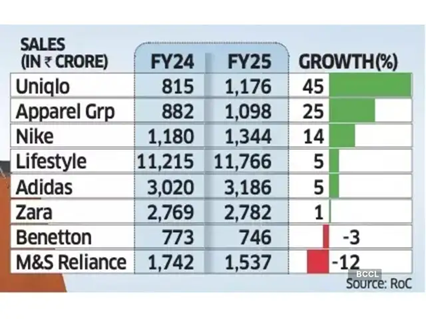

While Marks & Spencer, Benetton, and Adidas are battling waning demand, Uniqlo and Nike are gaining fresh ground, reflecting wider choices and increasingly discerning buyers in one of the world’s fastest-growing consumer economies.

Spanish brand Zara is facing stagnant growth while it tapered off at Apparel Group, which sells Aldo, and Charles & Keith brands in India. Experts termed the divergent sales performance as a potential structural shift instead of demand slowdown in India’s fashion and lifestyle market.

Devangshu Dutta, founder of retail consulting firm Third Eyesight, said consumers have clearly shifted towards function, even as trend-led brands continue to exist though they tend to be comparatively smaller. Some brands are also finding it harder to set or even follow trends the way they once did.

“This is especially true for Gen Z, which stays closely tuned to global trends and acts as the primary driver of fashion adoption,” said Dutta. “While older consumers may have greater spending power in absolute terms, it is younger shoppers who shape trends and influence product sales.”

Growth slowed across most leading retailers and fast-fashion brands in the country in FY24 as high inflation and stagnant incomes crimped discretionary spending.

While the trend remained the same for many even in FY25, select brands staged a strong rebound. For instance, Nike India’s sales rose 14% in FY25, up from a 4% increase in the previous year, while Uniqlo accelerated growth to 45%, from 31% in FY24.

Revival after Festive Season

Even Lifestyle, India’s biggest department store chain, grew 5% last fiscal, rebounding from a 4% decline in FY24.

Uniqlo said it continues to see steady momentum in India, supported by strong customer response, retail expansion, rising brand awareness, and a strong ecommerce uplift. “India is now among Uniqlo’s fastest-growing markets in Asia and plays a meaningful role in the region’s overall business,” Kenji Inoue, chief financial officer and chief operating officer, Uniqlo India told ET. “The country’s young demographic, growing focus on quality, and increasing appreciation for functional everyday clothing have all contributed to this progress.”

According to the Retailers Association of India (RAI), sales growth in organised retail segments such as apparel, footwear, beauty and quick service restaurants (QSR) saw single-digit sales growth last fiscal year but the market has recovered after the festive season with double-digit sales performance.

“Demand has improved, but it isn’t broad-based,” said Kumar Rajagopalan, chief executive at RAI which represents organised retailers. “With more fashion options available, Indian consumers are becoming more selective, and growth is coming to brands that offer a strong value proposition and not the cheapest products, but those where prices are justified by innovation, design and quality.”

In FY25, Apparel Group recorded a 25% sales growth, slowing from a 37% increase a year ago. Inditex Trent, which sells Zara in India, saw flat sales compared with an 8% growth in FY24.

Adidas too saw its revenue growth rate slowing to 5% from 20% in the previous fiscal. Sales of M&S and Benetton fell 12% and 3% each, respectively.

Being the world’s most populous nation, India is an attractive market for apparel brands, especially with youngsters increasingly embracing western-style clothing. However, most international and premium brands have been competing for a relatively narrow slice of the sales pie in large urban centres.

(Published in Economic Times)

admin

December 1, 2025

Priyamvada C, Mint

1 Dec 2025

A wave of investor capital is flowing into India’s laboratory-grown diamond (LGD) segment, as fastscaling brands tap rising consumer adoption in a market now worth well over $300 million. New-age brands have raised multiple rounds of capital on the back of growing market share and improving margins.

Actor Shilpa Shetty-backed Limelight, which is in talks to raise its second round of capital this year, joins the growing list of other small brands such as Onya, Giva, Jewelbox, Lucira Jewellery and Aukera, among others, who have snagged monies in recent months. Limelight has appointed Ambit Capital to raise about $20 million to fund its expansion plans, two people familiar with the matter said.

Confirming the fundraise, the six year-old company’s co-founder Pooja Madhavan said the funds will be used towards store expansion and brand building as it looks to touch 100 stores over the next year. “We are in final talks with growth PE funds and reputed family offices (for the fundraise),” she told Mint.

Other similar fundraises include Onya’s ₹5.5 crore in a pre-seed round led by Zeropearl VC last week, Aukera’s $15 million raise led by Peak XV Partners and Aditya Birla Ventures-backed Giva raised ₹530 crore in an internal round led by Premji Invest, Epiq Capital and Edelweiss Discovery Fund, as it looks to scale up its lab-grown diamond offerings.

Nine pure-play lab grown diamond startups collectively raised a record $26.4 million in 2025, compared with $4.7 million across eight startups last year, data from market intelligence provider Tracxn showed.

The development comes as India’s lab-grown diamond jewellery market, valued at about $300-350 million in 2024, expects to grow at a compound annual growth rate (CAGR) of 15% over the next decade, as per consultancy firm Redseer’s estimates. As the market evolves, several prominent jewellery brands will gradually pivot from exclusively natural/mined diamonds in favour of lab-grown alternatives, alongside high-end jewellers incorporating the lab-growns into their select collections, which will drive sales volumes and act as an affordable entry point for consumers.

This segment has particularly picked pace in the last five years, with millennials and gen Z leading this shift, driven by better value, trendier designs from new-age brands, and growing comfort with lab-grown diamonds as a certified, high-quality product. This category has also widened beyond occasional fashion to gifting, daily wear and increasingly bridal, reflecting sustained consumer confidence and a willingness to treat them as a mainstream jewellery option, Rohan Agarwal, partner at Redseer told Mint in an emailed statement.

He further added that new-age brands have steadily gained market share in the mid-ticket gifting and daily wear segment with many trying to push into premium ranges. While the competitive landscape is still evolving, incumbents have already started responding by launching LGD lines of their own, although the extent to which they can challenge remains to be seen.

Major Indian brands that are considering a foray into this category include Malabar Gold & Diamonds, Senco Gold, which has launched the subbrand Sennes and Tata’s Trent, which launched its brand Pome in Westside stores.

Devangshu Dutta, founder and chief executive officer at Delhi-based consulting firm Third Eyesight, echoed the sentiment. He explained that new-age lab grown diamond players are forcing traditional jewellers to introduce LGD options or risk losing younger customers. “Not just precious jewellery brands, even those that started as fashion jewellery are expanding their range with LGD designs.”

“Down the road, there is potentially scope for consolidation as investors tend to prefer a handful of scaled platforms with strong brand recall and robust economics. So, as the category matures, there may be strategic acquisitions by large jewellery houses and corporates, as well as mergers among funded startups,” he added.

Those startups that can combine in-house manufacturing, design capabilities and data-driven retail expansion would be at an advantage, Dutta said. “Key future growth areas for LGD startups include omnichannel retail presence within India, with offline stores especially in demand-dense locations such as the metros and Tier 1 cities, export markets both with potential cost advantages and brand expansion, and extending into fashion jewellery, everyday wear, coloured lab grown stones and even luxury collaborations that position lab grown as aspirational rather than merely budget friendly.”

(Published in Mint)

admin

September 17, 2025

Sowmya Ramasubramanian, Mint

17 September 2025

Snapdeal, run by AceVector, is relying on strong growth in fashion and apparel to strengthen its position in the competitive e-commerce space, especially during the high-stakes festive season when customer loyalty is low. According to CEO Achint Setia, the company has seen its fashion and lifestyle categories triple in growth this year, though exact figures remain undisclosed.

“Fashion has been a standout category this year and, in fact, has been possibly the fastest-growing one so far. Overall, lifestyle [including fashion, home decor, and kitchen] already accounts for 90% of our business today, and fashion is a major driving force,” Setia told Mint in an interview.

Setia was appointed to the role in January, replacing Himanshu Chakrawarti, who led Snapdeal and its subsidiary Stellaro Brands for three years. Setia has over two decades of experience across marketing and strategy roles in firms like Myntra, Viacom18 Media, and Zalora Group.

While the festival season is a key period for all consumer-facing brands and platforms, this year is important for Snapdeal as it is currently waiting for the Securities and Exchange Board of India (Sebi) clearance to list in the public markets.

“Approval from Sebi before the end of the financial year is crucial for Snapdeal. If they don’t get it, or if they have to refile, they’ll need to update their IPO documents with a full year of financial data. This means the festive season performance will be key in shaping investor sentiment, especially in a volatile market,” said a senior e-commerce executive, asking not to be named.

The firm filed its draft papers for an IPO reportedly to raise ₹500 crore through the confidential route in July, which allows it to withhold public disclosure of IPO details until later stages. Setia declined to comment on the progress of the filing.

Despite its early entry, Snapdeal is yet to make a mark among the top e-commerce players in the country by both market share and volume of transactions. For context, industry estimates show Flipkart as the market leader with 48% share, followed by Meesho and Amazon. The Indian e-commerce market is projected to grow at a compound annual growth rate (CAGR) of 21% and reach $325 billion dollars in 2030 as per an October 2024 report by Deloitte.

Founded in 2010 by Kunal Bahl and Rohit Bansal, Snapdeal was initially launched as a daily deals platform and later pivoted to a full-fledged marketplace in 2011. Over the years it raised more than $1.8 billion in funding from Softbank, Alibaba group, Foxconn and Blackrock among others. However, intense competition and the absence of a distinct growth strategy have gradually eroded Snapdeal’s momentum in the e-commerce space.

Snapdeal largely caters to cities outside metropolitan areas where value retail has picked up in recent years. Within this, fashion remains the top growth driver-with more than 80% of orders placed priced below 1599 and 80% of them com-ing from small town India, accord-ing to CEO Setia. “For us, it’s about the value-conscious mindset that could be sitting out of anywhere,” he noted.

Over the last few months, Snapdeal has invested substantially in in-house festive campaigns, as well as technology and tools for returns forecasting and logistics. According to Setia, it has also expanded its seller portfolio, adding more from key clusters like Tirupur, Surat, Ludhiana, and Agra.

According to a September 2024 report by market research firm Centrum, the mass-market fashion segment accounts for 56% of India’s total apparel market.

However, offline continues to account for more than half the sales, with Tata’s Trent, D-Mart, and Vishal Mega Mart offering a sufficient selection of price-conscious consumers in smaller towns.

While small-town India offers a wide online shopping-savvy market waiting to be captured, Meesho has raced past Snapdeal in those geographies, especially in value commerce.

“For a very long time, Snapdeal has been positioned as an e-commerce platform for Bharat, but it doesn’t necessarily hold a strong position. Meesho, Flipkart and Amazon have expanded their presence in these markets over the years, which means competition is so much more now,” said Devangshu Dutta, founder and chief executive officer at consulting firm Third Eyesight.

(Published in Mint)

admin

May 5, 2025

Mint, 5 May 2026

Priyamvada C., Sneha Shah

Urban India’s pet parents are driving a wave of investor interest in the pet care space. A clutch of startups such as Heads Up For Tails, Supertails, and Vetic are now in fundraising talks amid rising demand for premium products and services

While Supertails looks to raise about ₹200 crore by the end of this year, Heads Up For Tails is eyeing an investment from domestic investment firm 360 One Asset over the next few months, according to mul tiple people familiar with the matter.

Vetic, a tech-enabled chain of pet clinics, is looking to raise a sizeable round and has begun discussions with investors, they said, adding that some of these transactions may see existing investors part exit their stake.

Supertails and Vetic did not immediately respond to Mint’s requests for a comment. While 360 One declined to comment, Heads Up For Tails’ founder Rashi Narang denied the development.

Investor interest in pet care surged in the years following the pandemic, driven by a wave of new pet adoptions and rising disposable incomes. In 2023, pet care startups raised a record $66.3 million across 16 rounds, led by one major transaction ― Drool’s $60 million fundraise.

While 2023 saw a funding spike driven by Drool’s large deal, overall funding activity in 2024 was more broad-based, with fundraising at $17.9 million spanning 13 rounds, as per Tracxn.

“Pet ownership in India is estimated to be less than 10% of overall households, but growing at a rapid pace with rising incomes, especially among urban consumers. In developed economies, pet ownership can exceed three in four households, and that headroom for growth is reflected among the upper income segments in India,” said Devangshu Dutta, chief executive of Third Eyesight, a management consulting firm.

He added that urban couples and singles in many cases are even opting to become “pet parents” instead of having children.

Platforms such as Supertails, Drools and Heads Up For Tails have been the big beneficiaries of this shift. Drools raised $60 million from LVMH-backed private equity firm L Catterton in 2023, while Supertails raised $15 million led by RPSG Capital Ventures in February last year.

Similarly, Supertails, which is in talks to acquire Blue 7 Vets, a multi speciality veterinary clinic, as part of its strategy to expand offline, will also raise capital to fund the acquisition of new customers, investments in technology, and the expansion of healthcare services, including Super-tails Pharmacy and build an omni-channel experience for consumers.

The company raised about $15 million in its series B funding round last year led by RPSG Capital Ventures and existing investors Fireside Ventures, Saama Capital, DSG Consumer Partners and Sauce VC.

(Published in Mint)

admin

December 31, 2024

Jasodhara Banerjee, Forbes India

31 December 2024

Once, there was alabaster. Then, there was porcelain. And now there is glass. And no, we are not talking about the different kinds material to make fine, delicate objet d’art, but the quality and texture of facial skin—smooth, flawless and luminescent—that humans aspire to.

While a Google search for the term ‘glass skin’ will churn out hundreds of results that describe not just what the term means—tracing it to Korean skin care routines and products—but also detail the meticulous steps, varying between five and 11, that will apparently make you look like your favourite K-pop singer or K-drama actor. Like all things K (read: Korean), be it television and OTT serials, or food and clothes, K-beauty seems to have taken the Indian market by storm. A search for ‘Korean brands’ on online platforms such as Nykaa and Tira Beauty brings up more than a thousand products, ranging from ₹75 for a facial sheet mask to ₹17,900 for 60 ml of face cream. Clearly, there is something for everybody.

Fuelling this surge has been a plethora of factors, including the rise of online marketplaces that have made Indian and foreign skin care and beauty products more accessible than before, the thriving ecosystem of influencers and content creators that has revolutionised the marketing of these products, and, of course, consumer demand for products that claim to have the goodness of natural ingredients backed by the surety of science. And, surprising as it may seem, the Covid-19 pandemic and accompanying lockdowns also seem to have played a role in this.

Case in point is Amorepacific Corporation, a Seoul-headquartered beauty and cosmetics company that operates in more than 50 countries, and has a portfolio of more than 30 brands, such as Sulwhasoo, Laneige, Mamonde, Etude House and Innisfree. It is one of the largest cosmetics companies, not just in South Korea, but in the world.

“We are the number one beauty and personal care brand in South Korea and were the first Korean corporation to enter India with direct management, with our own subsidiary,” says Paul Lee, managing director and country head, Amorepacific India. “We started our business in India with Innisfree, which uses natural ingredients from Jeju Island in South Korea. We started with Innisfree because India had a huge demand for brands with natural products. Then we introduced Laneige and Sulwhasoo, which fall in the luxury skin care segment, and these were followed by Etude, which is a makeup brand.”

Amorepacific entered India sometime in 2012, taking tentative steps in a fledgling market with minimal investments and a retail store in Delhi’s Khan market. “At that time, the awareness of K-beauty was very small, and our momentum of growth started with the popularity of dedicated ecommerce players like Nykaa. In the last seven years, our annual growth has been 50 percent, our current growth is 60 percent year-on-year,” says Lee.

A potent potion for growth

Although industry players and experts feel there are multiple factors behind this growth, the popularity of Korean cultural elements is a significant one. “Korean beauty and personal care brands have multiple enabling factors. The global expansion of Korean beauty and personal care products has been on the back of a cultural export wave like any other earlier in history; in this case through the growing popularity of K-pop and K-dramas,” says Devangshu Dutta, founder, Third Eyesight and co-founder, PVC Partners. “In India, these brands initially had an influence in the Northeastern states, where customers are usually ahead on the fashion curve and also find resonance with the look of these brands.” He adds that factors such as the increasing number of Indian tourists to East Asian countries, and the growing presence of Korean and Japanese expatriates within India have also supported the growing footprint of these brands.

A spokesperson for Tira Beauty, which was launched in April 2023, agrees with Dutta, and attributes the demand for K-beauty products to the exposure that consumers have to K-dramas and K-pop. However, she adds that a significant factor is rooted in the products themselves. “These are the innovations that these brands are bringing to the table,” she explains. “The kind of formulations they offer are very well-suited for the Indian consumer. The ingredients are very efficacy oriented, and deliver a lot of quality, thus resolving a lot of concerns that consumers in India have.”

For instance, skin hydration is a core need of consumers, and a lot of Korean skin care products focus on hyaluronic acid as an ingredient. “Consumers who have sensitive skin or inflammation as a key concern get to use ingredients like centella asiatica, that a lot of Korean products use,” she says.

The spokesperson adds that the texture of the products is also a factor behind their popularity in India: “A lot of Korean sunscreens are light weight, a lot of their essences are suited for the Indian skin and the Indian weather. Both these factors are contributing to the rise we are witnessing in the space of K-beauty.”

Lee of Amorepacific highlights the use of unique ingredients such as fermented beans, ginseng and green tea that were never used before by American or European companies. There are also many options for consumers to choose from, depending on what is best suited for them. For instance, there is a product line with green tea for consumers with sensitive skin, and the same products are available for those with dry skin. “There are three key metrics that we have seen among Indian consumers: One is the demand for premium quality, two is the demand for glass skin, and the third is reliability.”

Lee also attributes market factors that have been instrumental in making Korean products more accessible to Indian consumers. “There has been a lot of change before Covid, and after Covid. From the macro perspective, the number of internet users with access to low-cost data plans has increased. During the Covid-19 pandemic, the number of new people watching OTT platforms such as Netflix also surged. From the Netflix perspective, I think India is one of the top three countries, where the number of subscribers is concerned.”

According to the Korea Trade-Investment Promotion Agency, the beauty market in India saw substantial growth following the Covid-19 pandemic and is projected to expand by 10 percent annually from 2022 to 2027, more than twice the global average growth rate for the beauty sector. According to market analyst Mordor Intelligence, the K-beauty market in India is expected to grow annually by 9.4 percent from 2021 to 2026.

Lee highlights the popularity of Korean OTT series such as Squid Games in making Indians familiar with Korean culture, and YouTube videos making a lot of people aware of K-beauty. “When we started operating in India, there were hardly two or three brands operating here, but currently there are more than 60 Korean brands in India. The influence of TV and music content has made people familiar with Korean culture, which is similar to Indian culture in being family-centric,” he adds.

Content creator Scherezade Shroff Talwar says, “The Hallyu [Korean] wave during the pandemic has definitely contributed to, what I would say, an over-consumption of Korean culture and I definitely contribute to it as well. K-beauty products have been around in India for a while, but with the increasing popularity of K-dramas and K-pop, people are seeing more such content across multiple platforms. This has contributed to the rising number of Korean brands in India, and the use of their products.” She recalls how, in November, she was in South Korea with her K-drama club, and the members had lists of the products that they wanted to buy there because they are not available in India.

According to a September report by market research firm Mintel, social media analysis in India reveals that there have been 6.2 million posts in the last two years discussing K-drama, K-pop, and K-beauty trends, predominantly among the 19 to 24 age group. This continued popularity in K-pop throughout the APAC region influences consumers’ interest in Korean skin care and beauty products, the report adds.

Lee says that Korean beauty companies have also been prompt to react to the demands in the market. For instance, Innisfree introduces new products every three months, and they are based on consumer feedback through social media and actual stores. Given the demand from Indian consumers, Amorepacific has also formed a task force at its headquarters which is dedicated to reviewing and studying the Indian market, with plans bring in more brands and businesses.

Data shows, adds Lee, that the import of Korean skin care products into India is increasing by 63 percent every year, going up four times compared to 2020. Amorepacific’s own research shows that 53 percent of Indian beauty consumers have already tried Korean products. “Fifteen percent of the entire skin care products market is now dominated by Korean products,” he claims.

Although Amorepacific decided to close all 23 of its exclusive stores in India because of the losses suffered during the pandemic, it decided to partner instead with local channels such as Nykaa, Tira Beauty and SS Beauty, and its products are today available across 400 counters in 45 cities. “Although our company is seeing 60 percent growth every year now, our retail area is doubling every year,” says Lee. “Our aim is to be available in 500 counters within a year.”

The availability and accessibility of Korean skin care and beauty products have also coincided with the rise of marketing products through influencers and content creators. The spokesperson for Tira Beauty says that influencers have played a massive role in the popularity of Korean products. “One of the reasons why K-beauty products do well across markets is because Gen-Z consumers tend to follow a lot of these influencers,” she explains. For instance, Tira launched the Beauty of Joseon sunscreen, and it went out of stock very quickly. “We experienced this because there was a lot of awareness due to influencer activations, and there’s a certain amount of virality these products enjoy even before they are launched.” She also gives the example of the brand Tirtir, which was launched on Tira Beauty in India in November. “The brand rolled out samples to influencers in India in July, and that helped propel demand to a great extent.”

According to business consulting firm Grand View Research, celebrity influencers have been beneficial to marketers due to their global reach, which often transcends cultural boundaries. Hence, the top strategy used by Korean cosmetics brands is to sell their products to Korean celebrities. Storytelling using Korean celebrities as brand ambassadors, and streaming advertisements and video tutorials all over the social media platform are some of the major strategies adopted by K-beauty brands.

Grand View Research gives the example of the lip layering bar of Laniege, which has emerged as a convenient tool for those who want to get the trendy gradient lip look with just a single application. Celebrities such as actors Song Hye Kyo and Lee Sung Kyung have used the product, enhancing its appeal and desirability among consumers.

Celebrities from different parts of the world promote K-beauty products, and this fosters a cross-cultural appeal and encourages individuals from diverse backgrounds to explore and adopt these products in their skin care routines. Following this global trend, in India, young celebrities have been roped in to appeal to Gen-Z consumers. For instance, actor Palak Tiwari became the first Indian brand ambassador for Etude, while actor Wamiqa Gabbi became first Indian brand ambassador for Innisfree, and Sara Tendulkar, daughter of cricketing legend Sachin Tendulkar, is the brand ambassador for Laneige.

Dutta of Third Eyesight says, “Influencers certainly have played a role in building the buzz around K-beauty and have formed a relatively cost-effective means to spread the message in the past. However, in recent years with a growing number of social influencers, there is more clutter as well on the channels.”

India not in the big league, but demanding

Although the rise of K-beauty products in India has been significant, the country remains a far smaller market for these brands compared to markets such as the US, Europe and China. According to Grand View Research, the global K-beauty products market size was valued at $91.99 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.3 percent from 2023 to 2030.

The consulting firm says the Korean cosmetics industry grew steadily during the Covid-19 pandemic, owing to an increase in awareness of the numerous benefits offered by the products. Moreover, due to a rise in popularity among consumers, major K-beauty companies are taking initiatives such as R&D, product launches, mergers and acquisitions to retain shares in the market and respond to changes in the marketplace by introducing a range of items.

Grand View Research valued the US market, one of the largest for K-beauty products, at $20.2 billion in 2021 and expects it to grow at a CAGR of 8.8 percent between 2023 and 2030. Compared to this, Statista valued the India K-beauty market at $486 million in 2021, and expects it to grow to over $1.3 billion by 2032.

Lee of Amorepacific says the US remains the largest beauty market as a whole, followed by China, Japan, the UK, France and India. “One of the differentiating factors between the US and Indian consumers is that the premium market in India is very small, and it is still a mass-product driven market,” he says. “Secondly, ecommerce in India is still quite small. In South Korea and the US, ecommerce just in the beauty segment, is 30 to 40 percent, while in India it is 13 percent. India is traditionally an offline market.”

He adds that despite the growth, Indians remain sceptical about whether Korean products are suitable for Indian skins, and there is demand for products that are made only for Indians. “Localisation, therefore, has become important for the company. Although we conduct clinical trials in different geographies, we are starting to take more feedback from Indian consumers, and we are ready to develop products only for the Indian market. For instance, we have introduced the Innisfree kajal and the Innisfree hair massage oil, and have developed lip colours for the Indian market.”

Although the company did not divulge revenue figures, it is expecting to grow six times in the next six years in India, and plans to introduce at least five more brands within the next seven years in this market.

(Published in Forbes India)