admin

January 15, 2026

Sagar Malviya, ET Bureau

Mumbai, 15 January 2026

It’s mostly a tale of two halves for top western fashion labels in India after the runaway sales and retail expansion in the years soon after the pandemic.

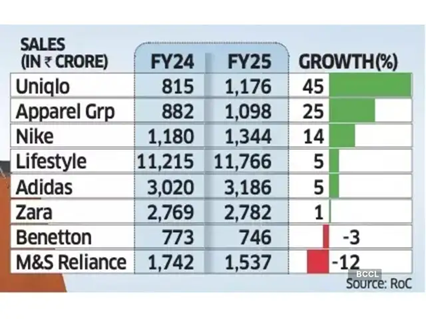

While Marks & Spencer, Benetton, and Adidas are battling waning demand, Uniqlo and Nike are gaining fresh ground, reflecting wider choices and increasingly discerning buyers in one of the world’s fastest-growing consumer economies.

Spanish brand Zara is facing stagnant growth while it tapered off at Apparel Group, which sells Aldo, and Charles & Keith brands in India. Experts termed the divergent sales performance as a potential structural shift instead of demand slowdown in India’s fashion and lifestyle market.

Devangshu Dutta, founder of retail consulting firm Third Eyesight, said consumers have clearly shifted towards function, even as trend-led brands continue to exist though they tend to be comparatively smaller. Some brands are also finding it harder to set or even follow trends the way they once did.

“This is especially true for Gen Z, which stays closely tuned to global trends and acts as the primary driver of fashion adoption,” said Dutta. “While older consumers may have greater spending power in absolute terms, it is younger shoppers who shape trends and influence product sales.”

Growth slowed across most leading retailers and fast-fashion brands in the country in FY24 as high inflation and stagnant incomes crimped discretionary spending.

While the trend remained the same for many even in FY25, select brands staged a strong rebound. For instance, Nike India’s sales rose 14% in FY25, up from a 4% increase in the previous year, while Uniqlo accelerated growth to 45%, from 31% in FY24.

Revival after Festive Season

Even Lifestyle, India’s biggest department store chain, grew 5% last fiscal, rebounding from a 4% decline in FY24.

Uniqlo said it continues to see steady momentum in India, supported by strong customer response, retail expansion, rising brand awareness, and a strong ecommerce uplift. “India is now among Uniqlo’s fastest-growing markets in Asia and plays a meaningful role in the region’s overall business,” Kenji Inoue, chief financial officer and chief operating officer, Uniqlo India told ET. “The country’s young demographic, growing focus on quality, and increasing appreciation for functional everyday clothing have all contributed to this progress.”

According to the Retailers Association of India (RAI), sales growth in organised retail segments such as apparel, footwear, beauty and quick service restaurants (QSR) saw single-digit sales growth last fiscal year but the market has recovered after the festive season with double-digit sales performance.

“Demand has improved, but it isn’t broad-based,” said Kumar Rajagopalan, chief executive at RAI which represents organised retailers. “With more fashion options available, Indian consumers are becoming more selective, and growth is coming to brands that offer a strong value proposition and not the cheapest products, but those where prices are justified by innovation, design and quality.”

In FY25, Apparel Group recorded a 25% sales growth, slowing from a 37% increase a year ago. Inditex Trent, which sells Zara in India, saw flat sales compared with an 8% growth in FY24.

Adidas too saw its revenue growth rate slowing to 5% from 20% in the previous fiscal. Sales of M&S and Benetton fell 12% and 3% each, respectively.

Being the world’s most populous nation, India is an attractive market for apparel brands, especially with youngsters increasingly embracing western-style clothing. However, most international and premium brands have been competing for a relatively narrow slice of the sales pie in large urban centres.

(Published in Economic Times)

admin

December 14, 2024

Sagar Malviya, Economic Times

Mumbai, 14 December 2024

Fast fashion was on a slow lane in the last fiscal year. Sales growth slowed for top retailers and fast fashion brands, show the latest regulatory filings of Marks & Spencer, Zara, H&M, Levi’s, Lifestyle, Uniqlo, Benetton and Celio. The bottom line too had taken a hit, with most brands posting lower profits in the fiscal year ended March 31. Sales growth of H&M and Zara fell from 40% in FY23 to 11% and 8% in FY24, show the filings with the Registrar of Companies. Levi’s growth slowed to 4% from 54% in FY23, while that of Uniqlo halved to 31% from 60%.

The current year is not looking good either, as sticky inflation and stagnant income weigh on consumer spending on discretionary products, say experts.

Devangshu Dutta, founder of retail consulting firm Third Eyesight, said the job market has been under pressure and slower income growth for urban consumer impacted demand, a trend likely to continue even during FY25.

“There is a visible slowdown led by the urban middle class who buy branded products. These brands have been targeting young upwardly mobile consumers, who are tightening the purse strings due to the current economic circumstances of hiring slack and fewer jobs,” said Dutta. “The situation is not hunky-dory at all, and this will continue over the next few quarters.”

Being the world’s most populous country, India is an attractive market for apparel brands, especially with youngsters increasingly embracing western-style clothing. But most international and premium brands have been competing for a relatively narrow slice of the population pie in large urban centres.

Over the past few years, top global apparel and fast fashion brands struck a strong chord with young customers, racking up sales growth of between 40% and 60% in FY23, bucking the trend in a market where the overall demand for discretionary products started slowing down. This has reversed now.

Consumers started reducing non-essential spending, such as on apparel, lifestyle products, electronics and dining out since early last year due to high inflation, increase in interest rates, job losses in sectors like startups and IT, and an overall slowdown in the economy.

According to the Retailers Association of India (RAI), sales growth in organised retail segments such as apparel, footwear, beauty and quick service restaurants halved to 9% last year and slowed further to about 5% in the first six months in the current fiscal year. This slowdown came after a surge in spending across segments-from clothes to cars-in the post-pandemic period, triggered by revenge shopping.

“The base post-pandemic was extremely high, and that kind of growth is not sustainable as there is nothing spectacular in economy to drive demand,” said Kumar Rajagopalan, chief executive officer at the RAI that represents organised retailers. “Our bet was on the festive and wedding season, but we will have to wait and watch until next year for the performance numbers,” he said.

(Published in Economic Times)

admin

May 20, 2024

Sagar Malviya, Economic Times

Mumbai, 20 May 2024

Spain’s Inditex, the owner of fashion brand Zara, saw its slowest ever sales growth in India, excluding the pandemic year, in FY24 as the world’s largest fashion group faced rising competition from global rivals in the clothing market that is increasingly getting cluttered.

Inditex Trent, its joint venture with Tata that runs 23 of Zara stores in India, saw revenue rise 8% to Rs 2,775 crore last fiscal, significantly down from 40% growth a year ago, according to Trent’s annual report. Net profit was down too at Rs 244 crore, an 8% drop.

Zara has been a runaway success since its arrival in the country more than a decade ago but after initially doubling sales every two years, the brand’s rate of expansion had come down in the past few years. “The market is very competitive, and the challenges are real. Nevertheless, the opportunity pool and the size of the market means that there is space for multiple successful players. Trent remains well placed to navigate this next phase of growth by leveraging our platform and growth engines,” P Venkatesalu, chief executive officer at Trent, said in the report.

Trent that runs Westside has shifted focus on its lower priced fast fashion brand Zudio, which opened about four new stores every week on average last fiscal to take the total store count at 545 doors. Trent also has a separate association with the Inditex group to operate Massimo Dutti stores in India. The entity saw revenues rise 14% to Rs. 102 crore.

Experts said consumer demand has been affected in the past couple of years with brands having to work extra hard to get same-store growth and much of top-line growth has come for brands from store additions.

“Most international and premium Indian brands are competing for a relatively narrow slice of the population pie in the larger urban centres. While the Indian market is a bright spot amid the gloom in the world’s major economies, global pressures are likely to play a part in the confidence among brands to invest in expansion,” Devangshu Dutta, founder of retail consulting firm Third Eyesight, said, adding there is not necessarily “fatigue” for the brand.

“But if the contest for the consumer’s attention is more intense and the consumer’s choices are more fragmented across a wider choice of brands, that will definitely have an impact on any individual brand’s performance.”

Being the world’s second most-populous country, India is an attractive market for apparel brands, especially with youngsters increasingly embracing western-style clothing. Most of Zara’s back-end and merchandise sourcing are handled by Inditex, while the Tata expertise is mainly for identifying real estate and locations.

(Published in Economic Times)

admin

April 15, 2024

Sagar Malviya, Economic Times

Mumbai, 15 April 2024

Spanish fashion company Inditex said it will launch youth clothing brand Bershka and Zara Home in India this year.

“Bershka will open its first store in Mumbai Palladium, and Zara Home will open in Bangalore,” it said in its latest annual report.

Inditex had launched fast fashion brand Zara in 2010 and premium clothing brand Massimo Dutti eight years ago. Its new offering, Bershka, will pitch it directly against Reliance Retail’s Yousta, which too targets the younger consumer segment.

Being the world’s second most-populous country, India is an attractive market for apparel brands, especially with youngsters increasingly embracing Western-style clothing. Fast fashion brands such as Zara and H&M became runaway successes soon after they entered the country.

Experts said Bershka’s target consumer profile is mostly teens to mid-20s, slightly younger than that of Zara, which is pitched at 20-40-year-old fashion-driven customers.

“The product assortment is different, with a higher share of knits, fewer dresses and more casual overall compared to Zara, keeping in line with the lifestyles of the customer group. So in that sense it wouldn’t cannibalise Zara in any serious way, though some of the younger set among Zara buyers could migrate some of their purchases to Bershka,” said Devangshu Dutta, founder of retail consulting firm Third Eyesight. “The biggest question is, can they hit the price points that young Indian fashion consumers want as with domestic brands such as Zudio, Yousta and others, or will consumers overlook higher prices for the style mix and a European brand pull in significant numbers to make the brand viable.”

According to a recent report by Motilal Oswal, the ₹2.5 lakh crore value fashion segment accounts for 57% of the total apparel market and is one of the largest and fastest-growing segments. A substantial untapped opportunity beyond the metros and tier-1 cities, driven by better demographics, higher incomes and greater customer aspiration, has compelled several big players to enter a market that was previously dominated by regional and local operators.

Since its inception in 2016-17, Zudio has seen considerable expansion and reached nearly 400 standalone stores, outpacing most apparel brands primarily due to its competitively priced products with an average selling price of ₹300. Following the success of Zudio, a unit of the Tata Group’s Trent, the segment has seen the entry of national retailers in the affordable youth clothing segment such as Yousta by Reliance Retail, Style-Up by Aditya Birla Fashion and Retail and Shoppers Stop’s InTune.

(Published in Economic Times)

admin

February 23, 2024

Kailash Babar & Sagar Malviya, Economic Times

Mumbai, 23 February 2024

Tata Group and Reliance Industries, two of India’s largest conglomerates, are vying for premium retail real estate in Mumbai as they extend their footprints, creating rivalry in a city starved of marquee properties. From Zara and Starbucks to Westside and Titan, the Tata Group occupies nearly 25 million square feet of retail space in India. That is still no match for Reliance Industries that control three times more at 73 million sq ft for more than 100 local and global brands.

But in Mumbai, they are evenly matched, having nearly 3 million sq ft of retail space each. That is a quarter of what is considered the most prime retail real estate in the country, and both the retail giants are looking for more.

“In a modern retail environment, most visible locations contain more successful or larger brands. It just so happens that many of those brands are owned by either Reliance or the Tatas,” said Devangshu Dutta, founder of Third Eyesight, a strategy consulting firm.

“Tatas have been in retail for longer but also slower to scale up compared to Reliance which had this stated ambition of being the most dominant and put the money behind it,” he said.

In a market where demand is much higher than supply, developers and landlords seek to separate the wheat from the chaff, experts said. Ultimately, success in Mumbai’s retail real estate scene hinges on a delicate equilibrium between accommodating industry leaders and fostering a vibrant, varied shopping environment, they said. “In the competitive landscape of retail real estate in Mumbai, commercial developers and mall owners often face the strategic challenge of accommodating prominent retail brands,” said Abhishek Sharma, director, retail, at commercial real estate consultants Knight Frank India.

“These big brands, with a significant market share of 40-45% in the Indian retail sector, can easily be termed as industry giants and possess the potential to command 45-50% of space in any mall,” he said. According to Sharma, there may be perceptions of preferential treatments, but the dynamics are complex, and developers must balance the demand from these major brands with the need for a diverse tenant mix.

Tata Group entered retail in the late 1980s, initially by opening Titan watch stores and a decade later by launching department store Westside. So far, it has about 4,600 stores, including brands such as Tanishq, Starbucks, Westside, Zudio, Zara and Croma.

While Reliance Retail started in 2006, it overcompensated for its late entry by aggressively opening stores across formats. Reliance has over 18,774 stores across supermarkets, electronics, jewellery, and apparel space. It has also either partnered or acquired over 80 global brands, from Gap and Superdry to Balenciaga and Jimmy Choo. A diverse portfolio of brands across various segments through strategic partnerships and collaborations helps an entity like Reliance to leverage synergies and enhance retail presence, especially in malls, experts said.

“The array of brands with Reliance bouquet allows it to enter early into the project and set the tone and positioning of the mall,” said a retail leasing expert who requested not to be identified.

“This positively helps the mall to set its own positioning and future tenant mix. It also helps Reliance place their brands in most relevant zones within the mall. This will emerge as a clear differentiator in a city like Mumbai where brands are already jostling for space, which is the costliest in the country,” the person added.

(Published in Economic Times)