admin

January 15, 2026

Sagar Malviya, ET Bureau

Mumbai, 15 January 2026

It’s mostly a tale of two halves for top western fashion labels in India after the runaway sales and retail expansion in the years soon after the pandemic.

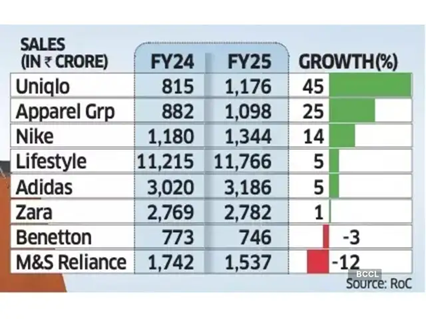

While Marks & Spencer, Benetton, and Adidas are battling waning demand, Uniqlo and Nike are gaining fresh ground, reflecting wider choices and increasingly discerning buyers in one of the world’s fastest-growing consumer economies.

Spanish brand Zara is facing stagnant growth while it tapered off at Apparel Group, which sells Aldo, and Charles & Keith brands in India. Experts termed the divergent sales performance as a potential structural shift instead of demand slowdown in India’s fashion and lifestyle market.

Devangshu Dutta, founder of retail consulting firm Third Eyesight, said consumers have clearly shifted towards function, even as trend-led brands continue to exist though they tend to be comparatively smaller. Some brands are also finding it harder to set or even follow trends the way they once did.

“This is especially true for Gen Z, which stays closely tuned to global trends and acts as the primary driver of fashion adoption,” said Dutta. “While older consumers may have greater spending power in absolute terms, it is younger shoppers who shape trends and influence product sales.”

Growth slowed across most leading retailers and fast-fashion brands in the country in FY24 as high inflation and stagnant incomes crimped discretionary spending.

While the trend remained the same for many even in FY25, select brands staged a strong rebound. For instance, Nike India’s sales rose 14% in FY25, up from a 4% increase in the previous year, while Uniqlo accelerated growth to 45%, from 31% in FY24.

Revival after Festive Season

Even Lifestyle, India’s biggest department store chain, grew 5% last fiscal, rebounding from a 4% decline in FY24.

Uniqlo said it continues to see steady momentum in India, supported by strong customer response, retail expansion, rising brand awareness, and a strong ecommerce uplift. “India is now among Uniqlo’s fastest-growing markets in Asia and plays a meaningful role in the region’s overall business,” Kenji Inoue, chief financial officer and chief operating officer, Uniqlo India told ET. “The country’s young demographic, growing focus on quality, and increasing appreciation for functional everyday clothing have all contributed to this progress.”

According to the Retailers Association of India (RAI), sales growth in organised retail segments such as apparel, footwear, beauty and quick service restaurants (QSR) saw single-digit sales growth last fiscal year but the market has recovered after the festive season with double-digit sales performance.

“Demand has improved, but it isn’t broad-based,” said Kumar Rajagopalan, chief executive at RAI which represents organised retailers. “With more fashion options available, Indian consumers are becoming more selective, and growth is coming to brands that offer a strong value proposition and not the cheapest products, but those where prices are justified by innovation, design and quality.”

In FY25, Apparel Group recorded a 25% sales growth, slowing from a 37% increase a year ago. Inditex Trent, which sells Zara in India, saw flat sales compared with an 8% growth in FY24.

Adidas too saw its revenue growth rate slowing to 5% from 20% in the previous fiscal. Sales of M&S and Benetton fell 12% and 3% each, respectively.

Being the world’s most populous nation, India is an attractive market for apparel brands, especially with youngsters increasingly embracing western-style clothing. However, most international and premium brands have been competing for a relatively narrow slice of the sales pie in large urban centres.

(Published in Economic Times)

admin

December 1, 2025

Priyamvada C, Mint

1 Dec 2025

A wave of investor capital is flowing into India’s laboratory-grown diamond (LGD) segment, as fastscaling brands tap rising consumer adoption in a market now worth well over $300 million. New-age brands have raised multiple rounds of capital on the back of growing market share and improving margins.

Actor Shilpa Shetty-backed Limelight, which is in talks to raise its second round of capital this year, joins the growing list of other small brands such as Onya, Giva, Jewelbox, Lucira Jewellery and Aukera, among others, who have snagged monies in recent months. Limelight has appointed Ambit Capital to raise about $20 million to fund its expansion plans, two people familiar with the matter said.

Confirming the fundraise, the six year-old company’s co-founder Pooja Madhavan said the funds will be used towards store expansion and brand building as it looks to touch 100 stores over the next year. “We are in final talks with growth PE funds and reputed family offices (for the fundraise),” she told Mint.

Other similar fundraises include Onya’s ₹5.5 crore in a pre-seed round led by Zeropearl VC last week, Aukera’s $15 million raise led by Peak XV Partners and Aditya Birla Ventures-backed Giva raised ₹530 crore in an internal round led by Premji Invest, Epiq Capital and Edelweiss Discovery Fund, as it looks to scale up its lab-grown diamond offerings.

Nine pure-play lab grown diamond startups collectively raised a record $26.4 million in 2025, compared with $4.7 million across eight startups last year, data from market intelligence provider Tracxn showed.

The development comes as India’s lab-grown diamond jewellery market, valued at about $300-350 million in 2024, expects to grow at a compound annual growth rate (CAGR) of 15% over the next decade, as per consultancy firm Redseer’s estimates. As the market evolves, several prominent jewellery brands will gradually pivot from exclusively natural/mined diamonds in favour of lab-grown alternatives, alongside high-end jewellers incorporating the lab-growns into their select collections, which will drive sales volumes and act as an affordable entry point for consumers.

This segment has particularly picked pace in the last five years, with millennials and gen Z leading this shift, driven by better value, trendier designs from new-age brands, and growing comfort with lab-grown diamonds as a certified, high-quality product. This category has also widened beyond occasional fashion to gifting, daily wear and increasingly bridal, reflecting sustained consumer confidence and a willingness to treat them as a mainstream jewellery option, Rohan Agarwal, partner at Redseer told Mint in an emailed statement.

He further added that new-age brands have steadily gained market share in the mid-ticket gifting and daily wear segment with many trying to push into premium ranges. While the competitive landscape is still evolving, incumbents have already started responding by launching LGD lines of their own, although the extent to which they can challenge remains to be seen.

Major Indian brands that are considering a foray into this category include Malabar Gold & Diamonds, Senco Gold, which has launched the subbrand Sennes and Tata’s Trent, which launched its brand Pome in Westside stores.

Devangshu Dutta, founder and chief executive officer at Delhi-based consulting firm Third Eyesight, echoed the sentiment. He explained that new-age lab grown diamond players are forcing traditional jewellers to introduce LGD options or risk losing younger customers. “Not just precious jewellery brands, even those that started as fashion jewellery are expanding their range with LGD designs.”

“Down the road, there is potentially scope for consolidation as investors tend to prefer a handful of scaled platforms with strong brand recall and robust economics. So, as the category matures, there may be strategic acquisitions by large jewellery houses and corporates, as well as mergers among funded startups,” he added.

Those startups that can combine in-house manufacturing, design capabilities and data-driven retail expansion would be at an advantage, Dutta said. “Key future growth areas for LGD startups include omnichannel retail presence within India, with offline stores especially in demand-dense locations such as the metros and Tier 1 cities, export markets both with potential cost advantages and brand expansion, and extending into fashion jewellery, everyday wear, coloured lab grown stones and even luxury collaborations that position lab grown as aspirational rather than merely budget friendly.”

(Published in Mint)

admin

September 24, 2025

Shabori Das & Sagar Malviya, Economic Times

Bengaluru/Mumbai, 24 September 2025

Chinese fast-fashion platform Shein plans to triple the number of launches in India and shrink its design-to-launch timeline by a third to deepen its push into an increasingly competitive market, a top official said.

The company, which re-entered India through a partnership with Reliance Retail in February this year, said it is overhauling its supply chain to enable faster turnaround times. To achieve this, it has moved away from large-scale manufacturing hubs to smaller production lines with each line focused on creating a single new design daily.

“Our current timelines, measured from ‘thought to site’, stand at 46 days. We are targeting 30 days,” said Vineeth Nair, chief executive of Reliance’s fashion platform Ajio that steers Shein in India. “We currently deliver 320 styles a day – about 10,000 a month – and plan to scale that to over 30,000 styles monthly in the coming months,” he told ET.

Speaking about the speed of manufacturing, Nair said, “We quantify our options in terms of production lines, with each line optimised to deliver one design option per day, rather than factories. Some of our large production units have been repurposed into multiple lines.”

Shein first launched in India in 2018 with its own online shop. However, the app was banned by the Ministry of Electronics and Information Technology (MeitY) along with TikTok, WeChat and over 55 other Chinese apps.

One of the primary issues and controversies surrounding Shein’s India operations was the use of the consumer data by the Chinese apparel retailer.

Under the current partnership model, Reliance Retail is operating Shein under licensing agreement and ensures complete customer data ownership as per the company.

Unlike international markets, Shein India products are made in India.

“It’s still early days – just about three months since we introduced Shein to the India Gen Z,” Nair said. “And we are still in the process of adding multiple products, which we intend to do in the next few months.”

He said the brand is witnessing two million daily average users, dominated by 21-year-old women who account for 62% of the traffic.

Shein, the world’s biggest ecommerce-centred fashion retailer, however, may find it hard to replicate its global success in India, according to Devangshu Dutta, founder of retail consulting firm Third Eyesight.

“Shein’s edge internationally has been its speed of dropping its products, and the width of its product category. The India model is not the same. The India model of fashion is slower, and the product category width is not as large,” he noted. “Hence, the brand will in all probability end up competing with the already established market like Myntra, Zudio and the likes.”

(Published in Economic Times)

admin

March 20, 2025

Sagar Malviya, Economic Times

Mumbai, 20 March 2025

Established beauty product makers such as Forest Essentials, Colorbar, Kama Ayurveda, Body Shop, VLCC Personal Care and Lotus Herbals saw a slowdown in sales growth in FY24, according to the latest Registrar of Companies filings. Consumers favoured new-age rivals such as Minimalist and Pilgrim, specialised derma brands, as well as global labels Shiseido, Innisfree and Eucerin.

Sales growth of established brands mostly in the natural skincare segment, more than halved to single digits during the previous financial year amid a broader economic slump.

In contrast, companies such as L’Oreal, Nykaa and Sephora continued to grow at 12-34% on a significantly bigger base, even as they lost pace.

Direct-to-consumer brand Pilgrim more than doubled its sales, Minimalist’s revenue increased 80% and Foxtale’s sales surged 500% on a lower base.

“With most consumers tightening their budget on discretionary spends in FY24, they seem to have opted for brands that give instant benefits compared to natural products, which take time to be effective,” said Devangshu Dutta, founder of retail consulting firm Third Eyesight.

Over the past few years, there has been a flurry of beauty product launches, which have depended on platforms such as Nykaa and Tira for sales.

In the past two years, Nykaa has launched more than 350 brands, or In the past two years, or nearly one new label every alternate day on average.

This includes international brands such as CeraVe, Uriage and Versed, as well as home-grown brands such as Foxtale and Hyphen.

Reliance Retail, which entered beauty retailing with Tira two years ago, now sells nearly 1,000 brands, including exclusive labels such as Akind, Augustinus Badee, Allies of Skin, Kundal and Patchology.

“10 years ago we were only competing against big guys,” Vincent Karney, global chief executive of Beiersdorf, maker of Eucerin, Nivea and La Prakrit, told ET last month. “Now we have those local brands, and we have to become a bit more agile.”

On Nykaa, Fenty Beauty by Rihanna is the highest-selling brand in lipcare while Eucerin has become its biggest premium dermo-cosmetic serum. South Korean beauty brands Axis-Y, Tirtir and Numbuzin grew over 60% in 2024, with sales of toners increasing 104%, serums 45%, moisturisers 52% and sunscreens 154% on the platform.

VLCC and Colorbar did not respond to ET queries, while Forest Essentials was not reachable.

In January, Mike Jatania, cofounder and executive chairman of The Body Shop and Aurea Group, told ET, “There would be continuation of new entrants. Inflation is still a global issue and we will see the pressure. Competitive environment will be a challenge… 70% of our stores are showing decent growth. We have closed some stores and opened a few also, that’s the nature of the business.”

Ingredients Matter

Warnery of Beiersdorf emphasised the need to stay focused on “big innovation, by being able to talk to GenZ, (a position) which might be filled in by those local brands coming with basic ingredients.”

The likes of Minimalist, Ordinary and Pilgrim disclose active ingredients at a granular level, specifying the exact percentage of acid used in the product to appeal to GenZ users (those born between 1997 and early 2010s), who are said to be far more conscious of what they use on their skin compared to millennials (those born during 1980s to mid-1990s) and Gen X (those born from about 1965 to 1980).

Shoppers Stop, which manages brands such as Estee Lauder, Shiseido, Bobbi Brown, Mac and Clinique in India, sees the overall beauty market driven by companies focusing on consumers across age groups, and not just younger ones. Both natural and dermatological products are expected to find takers.

“While most new age brands tap younger cohorts, their pocket size allows them to mostly buy affordable products and the more affluent consumers opt for established global brands that have proven themselves since decades,” said Biju Kassim, chief executive, beauty, at Shoppers Stop. “Beauty is still not a habit in India and with hundreds of brands being launched, the focus is to grow penetration. There is also a shift from care to cure, driven by derma-recommended products and brands disclosing active ingredients, but it is still a niche sub-segment.”

Dutta of Third Eyesight sees the current trend as temporary. “We expect growth of (established) companies to bounce back in the current fiscal, driven by a strong demand for beauty,” he said, pointing especially to online platforms. India’s beauty and personal care market is expected to reach $34 billion by 2028, up from $21 billion now, driven by an online surge and a growing preference for high quality, premium beauty products according to a report by Nykaa and consulting firm Redseer.

Nicolas Hieronimus, chief executive of cosmetics giant L’Oreal, last year said consumers in India are more demanding and are not just settling for very basic things like putting an ingredient in a product such as salicylic acid or collagen. “That’s where L’Oreal has the best cards to play, and that’s where we really thrive,” he had told ET.

Beiersdorf, Unilever, L’Oreal and Shiseido, among the world’s largest cosmetics companies, have all identified India as a key growth driver, citing the burgeoning population and growing affinity for beauty products.

(Published in Economic Times)

admin

December 31, 2024

Jasodhara Banerjee, Forbes India

31 December 2024

Once, there was alabaster. Then, there was porcelain. And now there is glass. And no, we are not talking about the different kinds material to make fine, delicate objet d’art, but the quality and texture of facial skin—smooth, flawless and luminescent—that humans aspire to.

While a Google search for the term ‘glass skin’ will churn out hundreds of results that describe not just what the term means—tracing it to Korean skin care routines and products—but also detail the meticulous steps, varying between five and 11, that will apparently make you look like your favourite K-pop singer or K-drama actor. Like all things K (read: Korean), be it television and OTT serials, or food and clothes, K-beauty seems to have taken the Indian market by storm. A search for ‘Korean brands’ on online platforms such as Nykaa and Tira Beauty brings up more than a thousand products, ranging from ₹75 for a facial sheet mask to ₹17,900 for 60 ml of face cream. Clearly, there is something for everybody.

Fuelling this surge has been a plethora of factors, including the rise of online marketplaces that have made Indian and foreign skin care and beauty products more accessible than before, the thriving ecosystem of influencers and content creators that has revolutionised the marketing of these products, and, of course, consumer demand for products that claim to have the goodness of natural ingredients backed by the surety of science. And, surprising as it may seem, the Covid-19 pandemic and accompanying lockdowns also seem to have played a role in this.

Case in point is Amorepacific Corporation, a Seoul-headquartered beauty and cosmetics company that operates in more than 50 countries, and has a portfolio of more than 30 brands, such as Sulwhasoo, Laneige, Mamonde, Etude House and Innisfree. It is one of the largest cosmetics companies, not just in South Korea, but in the world.

“We are the number one beauty and personal care brand in South Korea and were the first Korean corporation to enter India with direct management, with our own subsidiary,” says Paul Lee, managing director and country head, Amorepacific India. “We started our business in India with Innisfree, which uses natural ingredients from Jeju Island in South Korea. We started with Innisfree because India had a huge demand for brands with natural products. Then we introduced Laneige and Sulwhasoo, which fall in the luxury skin care segment, and these were followed by Etude, which is a makeup brand.”

Amorepacific entered India sometime in 2012, taking tentative steps in a fledgling market with minimal investments and a retail store in Delhi’s Khan market. “At that time, the awareness of K-beauty was very small, and our momentum of growth started with the popularity of dedicated ecommerce players like Nykaa. In the last seven years, our annual growth has been 50 percent, our current growth is 60 percent year-on-year,” says Lee.

A potent potion for growth

Although industry players and experts feel there are multiple factors behind this growth, the popularity of Korean cultural elements is a significant one. “Korean beauty and personal care brands have multiple enabling factors. The global expansion of Korean beauty and personal care products has been on the back of a cultural export wave like any other earlier in history; in this case through the growing popularity of K-pop and K-dramas,” says Devangshu Dutta, founder, Third Eyesight and co-founder, PVC Partners. “In India, these brands initially had an influence in the Northeastern states, where customers are usually ahead on the fashion curve and also find resonance with the look of these brands.” He adds that factors such as the increasing number of Indian tourists to East Asian countries, and the growing presence of Korean and Japanese expatriates within India have also supported the growing footprint of these brands.

A spokesperson for Tira Beauty, which was launched in April 2023, agrees with Dutta, and attributes the demand for K-beauty products to the exposure that consumers have to K-dramas and K-pop. However, she adds that a significant factor is rooted in the products themselves. “These are the innovations that these brands are bringing to the table,” she explains. “The kind of formulations they offer are very well-suited for the Indian consumer. The ingredients are very efficacy oriented, and deliver a lot of quality, thus resolving a lot of concerns that consumers in India have.”

For instance, skin hydration is a core need of consumers, and a lot of Korean skin care products focus on hyaluronic acid as an ingredient. “Consumers who have sensitive skin or inflammation as a key concern get to use ingredients like centella asiatica, that a lot of Korean products use,” she says.

The spokesperson adds that the texture of the products is also a factor behind their popularity in India: “A lot of Korean sunscreens are light weight, a lot of their essences are suited for the Indian skin and the Indian weather. Both these factors are contributing to the rise we are witnessing in the space of K-beauty.”

Lee of Amorepacific highlights the use of unique ingredients such as fermented beans, ginseng and green tea that were never used before by American or European companies. There are also many options for consumers to choose from, depending on what is best suited for them. For instance, there is a product line with green tea for consumers with sensitive skin, and the same products are available for those with dry skin. “There are three key metrics that we have seen among Indian consumers: One is the demand for premium quality, two is the demand for glass skin, and the third is reliability.”

Lee also attributes market factors that have been instrumental in making Korean products more accessible to Indian consumers. “There has been a lot of change before Covid, and after Covid. From the macro perspective, the number of internet users with access to low-cost data plans has increased. During the Covid-19 pandemic, the number of new people watching OTT platforms such as Netflix also surged. From the Netflix perspective, I think India is one of the top three countries, where the number of subscribers is concerned.”

According to the Korea Trade-Investment Promotion Agency, the beauty market in India saw substantial growth following the Covid-19 pandemic and is projected to expand by 10 percent annually from 2022 to 2027, more than twice the global average growth rate for the beauty sector. According to market analyst Mordor Intelligence, the K-beauty market in India is expected to grow annually by 9.4 percent from 2021 to 2026.

Lee highlights the popularity of Korean OTT series such as Squid Games in making Indians familiar with Korean culture, and YouTube videos making a lot of people aware of K-beauty. “When we started operating in India, there were hardly two or three brands operating here, but currently there are more than 60 Korean brands in India. The influence of TV and music content has made people familiar with Korean culture, which is similar to Indian culture in being family-centric,” he adds.

Content creator Scherezade Shroff Talwar says, “The Hallyu [Korean] wave during the pandemic has definitely contributed to, what I would say, an over-consumption of Korean culture and I definitely contribute to it as well. K-beauty products have been around in India for a while, but with the increasing popularity of K-dramas and K-pop, people are seeing more such content across multiple platforms. This has contributed to the rising number of Korean brands in India, and the use of their products.” She recalls how, in November, she was in South Korea with her K-drama club, and the members had lists of the products that they wanted to buy there because they are not available in India.

According to a September report by market research firm Mintel, social media analysis in India reveals that there have been 6.2 million posts in the last two years discussing K-drama, K-pop, and K-beauty trends, predominantly among the 19 to 24 age group. This continued popularity in K-pop throughout the APAC region influences consumers’ interest in Korean skin care and beauty products, the report adds.

Lee says that Korean beauty companies have also been prompt to react to the demands in the market. For instance, Innisfree introduces new products every three months, and they are based on consumer feedback through social media and actual stores. Given the demand from Indian consumers, Amorepacific has also formed a task force at its headquarters which is dedicated to reviewing and studying the Indian market, with plans bring in more brands and businesses.

Data shows, adds Lee, that the import of Korean skin care products into India is increasing by 63 percent every year, going up four times compared to 2020. Amorepacific’s own research shows that 53 percent of Indian beauty consumers have already tried Korean products. “Fifteen percent of the entire skin care products market is now dominated by Korean products,” he claims.

Although Amorepacific decided to close all 23 of its exclusive stores in India because of the losses suffered during the pandemic, it decided to partner instead with local channels such as Nykaa, Tira Beauty and SS Beauty, and its products are today available across 400 counters in 45 cities. “Although our company is seeing 60 percent growth every year now, our retail area is doubling every year,” says Lee. “Our aim is to be available in 500 counters within a year.”

The availability and accessibility of Korean skin care and beauty products have also coincided with the rise of marketing products through influencers and content creators. The spokesperson for Tira Beauty says that influencers have played a massive role in the popularity of Korean products. “One of the reasons why K-beauty products do well across markets is because Gen-Z consumers tend to follow a lot of these influencers,” she explains. For instance, Tira launched the Beauty of Joseon sunscreen, and it went out of stock very quickly. “We experienced this because there was a lot of awareness due to influencer activations, and there’s a certain amount of virality these products enjoy even before they are launched.” She also gives the example of the brand Tirtir, which was launched on Tira Beauty in India in November. “The brand rolled out samples to influencers in India in July, and that helped propel demand to a great extent.”

According to business consulting firm Grand View Research, celebrity influencers have been beneficial to marketers due to their global reach, which often transcends cultural boundaries. Hence, the top strategy used by Korean cosmetics brands is to sell their products to Korean celebrities. Storytelling using Korean celebrities as brand ambassadors, and streaming advertisements and video tutorials all over the social media platform are some of the major strategies adopted by K-beauty brands.

Grand View Research gives the example of the lip layering bar of Laniege, which has emerged as a convenient tool for those who want to get the trendy gradient lip look with just a single application. Celebrities such as actors Song Hye Kyo and Lee Sung Kyung have used the product, enhancing its appeal and desirability among consumers.

Celebrities from different parts of the world promote K-beauty products, and this fosters a cross-cultural appeal and encourages individuals from diverse backgrounds to explore and adopt these products in their skin care routines. Following this global trend, in India, young celebrities have been roped in to appeal to Gen-Z consumers. For instance, actor Palak Tiwari became the first Indian brand ambassador for Etude, while actor Wamiqa Gabbi became first Indian brand ambassador for Innisfree, and Sara Tendulkar, daughter of cricketing legend Sachin Tendulkar, is the brand ambassador for Laneige.

Dutta of Third Eyesight says, “Influencers certainly have played a role in building the buzz around K-beauty and have formed a relatively cost-effective means to spread the message in the past. However, in recent years with a growing number of social influencers, there is more clutter as well on the channels.”

India not in the big league, but demanding

Although the rise of K-beauty products in India has been significant, the country remains a far smaller market for these brands compared to markets such as the US, Europe and China. According to Grand View Research, the global K-beauty products market size was valued at $91.99 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.3 percent from 2023 to 2030.

The consulting firm says the Korean cosmetics industry grew steadily during the Covid-19 pandemic, owing to an increase in awareness of the numerous benefits offered by the products. Moreover, due to a rise in popularity among consumers, major K-beauty companies are taking initiatives such as R&D, product launches, mergers and acquisitions to retain shares in the market and respond to changes in the marketplace by introducing a range of items.

Grand View Research valued the US market, one of the largest for K-beauty products, at $20.2 billion in 2021 and expects it to grow at a CAGR of 8.8 percent between 2023 and 2030. Compared to this, Statista valued the India K-beauty market at $486 million in 2021, and expects it to grow to over $1.3 billion by 2032.

Lee of Amorepacific says the US remains the largest beauty market as a whole, followed by China, Japan, the UK, France and India. “One of the differentiating factors between the US and Indian consumers is that the premium market in India is very small, and it is still a mass-product driven market,” he says. “Secondly, ecommerce in India is still quite small. In South Korea and the US, ecommerce just in the beauty segment, is 30 to 40 percent, while in India it is 13 percent. India is traditionally an offline market.”

He adds that despite the growth, Indians remain sceptical about whether Korean products are suitable for Indian skins, and there is demand for products that are made only for Indians. “Localisation, therefore, has become important for the company. Although we conduct clinical trials in different geographies, we are starting to take more feedback from Indian consumers, and we are ready to develop products only for the Indian market. For instance, we have introduced the Innisfree kajal and the Innisfree hair massage oil, and have developed lip colours for the Indian market.”

Although the company did not divulge revenue figures, it is expecting to grow six times in the next six years in India, and plans to introduce at least five more brands within the next seven years in this market.

(Published in Forbes India)