admin

January 15, 2026

Sagar Malviya, ET Bureau

Mumbai, 15 January 2026

It’s mostly a tale of two halves for top western fashion labels in India after the runaway sales and retail expansion in the years soon after the pandemic.

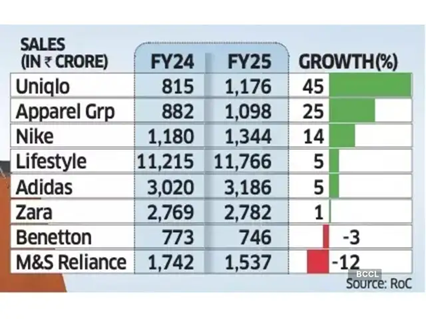

While Marks & Spencer, Benetton, and Adidas are battling waning demand, Uniqlo and Nike are gaining fresh ground, reflecting wider choices and increasingly discerning buyers in one of the world’s fastest-growing consumer economies.

Spanish brand Zara is facing stagnant growth while it tapered off at Apparel Group, which sells Aldo, and Charles & Keith brands in India. Experts termed the divergent sales performance as a potential structural shift instead of demand slowdown in India’s fashion and lifestyle market.

Devangshu Dutta, founder of retail consulting firm Third Eyesight, said consumers have clearly shifted towards function, even as trend-led brands continue to exist though they tend to be comparatively smaller. Some brands are also finding it harder to set or even follow trends the way they once did.

“This is especially true for Gen Z, which stays closely tuned to global trends and acts as the primary driver of fashion adoption,” said Dutta. “While older consumers may have greater spending power in absolute terms, it is younger shoppers who shape trends and influence product sales.”

Growth slowed across most leading retailers and fast-fashion brands in the country in FY24 as high inflation and stagnant incomes crimped discretionary spending.

While the trend remained the same for many even in FY25, select brands staged a strong rebound. For instance, Nike India’s sales rose 14% in FY25, up from a 4% increase in the previous year, while Uniqlo accelerated growth to 45%, from 31% in FY24.

Revival after Festive Season

Even Lifestyle, India’s biggest department store chain, grew 5% last fiscal, rebounding from a 4% decline in FY24.

Uniqlo said it continues to see steady momentum in India, supported by strong customer response, retail expansion, rising brand awareness, and a strong ecommerce uplift. “India is now among Uniqlo’s fastest-growing markets in Asia and plays a meaningful role in the region’s overall business,” Kenji Inoue, chief financial officer and chief operating officer, Uniqlo India told ET. “The country’s young demographic, growing focus on quality, and increasing appreciation for functional everyday clothing have all contributed to this progress.”

According to the Retailers Association of India (RAI), sales growth in organised retail segments such as apparel, footwear, beauty and quick service restaurants (QSR) saw single-digit sales growth last fiscal year but the market has recovered after the festive season with double-digit sales performance.

“Demand has improved, but it isn’t broad-based,” said Kumar Rajagopalan, chief executive at RAI which represents organised retailers. “With more fashion options available, Indian consumers are becoming more selective, and growth is coming to brands that offer a strong value proposition and not the cheapest products, but those where prices are justified by innovation, design and quality.”

In FY25, Apparel Group recorded a 25% sales growth, slowing from a 37% increase a year ago. Inditex Trent, which sells Zara in India, saw flat sales compared with an 8% growth in FY24.

Adidas too saw its revenue growth rate slowing to 5% from 20% in the previous fiscal. Sales of M&S and Benetton fell 12% and 3% each, respectively.

Being the world’s most populous nation, India is an attractive market for apparel brands, especially with youngsters increasingly embracing western-style clothing. However, most international and premium brands have been competing for a relatively narrow slice of the sales pie in large urban centres.

(Published in Economic Times)

admin

September 24, 2025

Shabori Das & Sagar Malviya, Economic Times

Bengaluru/Mumbai, 24 September 2025

Chinese fast-fashion platform Shein plans to triple the number of launches in India and shrink its design-to-launch timeline by a third to deepen its push into an increasingly competitive market, a top official said.

The company, which re-entered India through a partnership with Reliance Retail in February this year, said it is overhauling its supply chain to enable faster turnaround times. To achieve this, it has moved away from large-scale manufacturing hubs to smaller production lines with each line focused on creating a single new design daily.

“Our current timelines, measured from ‘thought to site’, stand at 46 days. We are targeting 30 days,” said Vineeth Nair, chief executive of Reliance’s fashion platform Ajio that steers Shein in India. “We currently deliver 320 styles a day – about 10,000 a month – and plan to scale that to over 30,000 styles monthly in the coming months,” he told ET.

Speaking about the speed of manufacturing, Nair said, “We quantify our options in terms of production lines, with each line optimised to deliver one design option per day, rather than factories. Some of our large production units have been repurposed into multiple lines.”

Shein first launched in India in 2018 with its own online shop. However, the app was banned by the Ministry of Electronics and Information Technology (MeitY) along with TikTok, WeChat and over 55 other Chinese apps.

One of the primary issues and controversies surrounding Shein’s India operations was the use of the consumer data by the Chinese apparel retailer.

Under the current partnership model, Reliance Retail is operating Shein under licensing agreement and ensures complete customer data ownership as per the company.

Unlike international markets, Shein India products are made in India.

“It’s still early days – just about three months since we introduced Shein to the India Gen Z,” Nair said. “And we are still in the process of adding multiple products, which we intend to do in the next few months.”

He said the brand is witnessing two million daily average users, dominated by 21-year-old women who account for 62% of the traffic.

Shein, the world’s biggest ecommerce-centred fashion retailer, however, may find it hard to replicate its global success in India, according to Devangshu Dutta, founder of retail consulting firm Third Eyesight.

“Shein’s edge internationally has been its speed of dropping its products, and the width of its product category. The India model is not the same. The India model of fashion is slower, and the product category width is not as large,” he noted. “Hence, the brand will in all probability end up competing with the already established market like Myntra, Zudio and the likes.”

(Published in Economic Times)

admin

May 23, 2025

By Kunal Purohit and Ananya Bhattacharya, Rest of World

Mumbai, India, 23 May 2025

Online retail continues to elude India’s richest man.

The Shein India app, launched by Mukesh Ambani’s Reliance Retail in partnership with the Chinese fast-fashion giant, has struggled to gain traction in a market where Amazon and Walmart have been fighting neck-to-neck for nearly a decade. Downloads for Shein India nosedived from 50,000 a day shortly after its launch in early February to 3,311 in early April, according to AppMagic, a U.S.-based app performance tracker.

In April, when U.S. tariffs hit China, the app saw renewed interest as it was in the news, but experts are unclear on whether this growth is sustainable.

“Unlike earlier times, now … [the] market is saturated with multiple options and offers, and user interest can quickly dwindle,” Yugal Joshi, partner at global research firm Everest Group, told Rest of World.

Kushal Bhatnagar of Indian consulting firm Redseer, however, sees the late-April spike as a healthy sign, given that Reliance has yet to run paid marketing campaigns for Shein.

Reliance Retail declined to respond to Rest of World’s queries about its partnership with Shein.

Reliance launched Shein for India five years after the original Shein app was banned in the country over border tensions with China. But the Shein that has returned is entirely separate from Shein’s global platform: Rather than selling made-in-China clothes and accessories directly to consumers, Shein now operates as a technology partner, while Reliance Retail handles the heavy lifting — from sourcing and manufacturing to distribution. All consumer data is managed by the Indian company.

The partnership is part of Ambani’s broader effort to overhaul his retail business, whose valuation fell to $50 billion in 2025 from $125 billion in 2022. Although the company has made a push into digital platforms like JioMart, Ajio, and most recently Shein India, the bulk of its retail revenue still comes from its 18,000 physical stores.

Lagging behind Amazon and Walmart-backed Flipkart, which together control nearly 60% of India’s e-commerce market, Reliance has spent years trying to break into the sector. Between 2020 and 2025, Ambani’s group acquired majority stakes in companies spanning digital services, online pharmaceuticals, and quick commerce. But the investments have yet to position Reliance as a serious challenger to Amazon and Flipkart.

Analysts say the Indian behemoth hopes to leverage Shein’s artificial intelligence-powered trendspotting and automated inventory systems to pursue an ambitious goal: capturing a major share of India’s e-commerce market, projected to hit $345 billion by 2030.

According to Kaustav Sengupta, director of insights at VisionNxt, an Indian government-funded initiative that uses AI to forecast fashion trends, such a model is likely to make good use of Reliance’s humongous customer data sets: more than 476 million subscribers for its Jio telecom brand, 300 million users for e-commerce platform JioMart, and 452 million subscribers for its news and entertainment portfolio, consisting of 63 channels, a streaming service, and digital news outlets.

“With these data points, Reliance wants to now sell fashion products, so all it needs is a system where it can feed all these data points,” Sengupta told Rest of World. He said the model would be able to predict best-selling products and suggest the right prices for them.

The original Shein app uses AI-driven models for intelligent warehousing and to spot customer trends before manufacturing a new product. It scales the manufacturing up or tweaks the designs based on the feedback. At any given time, the Shein website has a catalogue of more than 600,000 items. Its Indian iteration does not match up, according to reviews on the Google Play store. Several customer reviews for Reliance’s Shein app are critical of higher prices and reduced options. The app’s rating hovered at 2 out of 5 until February; in May, it climbed to 4.4, but reviews were still a mixed bag.

Reviews of the Indian app highlight the disparity with Shein’s global version, criticizing higher prices and a reduced selection of categories and styles.

As of April 25, Reliance Retail said only 12,000 products were live on Shein India, a stark contrast to the 600,000 items available on Shein’s global platforms. While Shein is reportedly set to debut on the London Stock Exchange this year, Ambani’s years-old promise to take Reliance Retail public remains unfulfilled.

Reliance Retail, which accounts for around 30% of the conglomerate’s overall business, is facing a slowdown in annual growth. Its sales rose just 7.9% in the fiscal year ending March 2025, down from 17.8% the previous year. Meanwhile, shares of rival Tata Group’s retail and fashion arm, Trent, have soared by 133%.

“Reliance would have looked at reviving that momentum and riding on it, while for Shein, adding India back on its portfolio of markets could be a plus point before its proposed public listing,” Devangshu Dutta, founder of Third Eyesight, a brand management consultancy that has worked with various global e-commerce brands including Ikea, told Rest of World.

A Reliance Retail official privy to information about its fast fashion expansion plans told Rest of World the partnership with Shein also hinges on global manufacturing ambitions as the Chinese company is trying to “source its products from other countries like India” to meet the “additional demand that is coming from newer markets.” Reliance Retail has tapped a network of small and midsize Indian manufacturers to locally source products, and its subsidiary Nextgen Fast Fashion Limited is leading the charge. “We need to first scale up our domestic manufacturing, before our partnership starts manufacturing for global markets. Let us see how that goes, first,” the official said, requesting anonymity as he is not authorized to share this information publicly.

India’s Gen Z population is at 377 million and counting, and their spending power is set to surpass $2 trillion by 2035, according to a 2024 report by Boston Consulting Group. Every fast-fashion retailer wants to capture this market, but it “is very new even for Reliance,” Rimjim Deka, founder of Indian fast-fashion platform Littlebox, told Rest of World.

Deka said smaller brands like hers “just see [a trend] and implement it,” which could take a large conglomerate months to do, by which time the trend may have lost relevance.

Reliance’s previous attempts to attract young shoppers with clothing brands like Foundry and Yousta failed to find much success. Anandita Bhuyan, who works in trend forecasting and product creation for fast-fashion clients like H&M and Myntra, told Rest of World the company has struggled to effectively leverage consumer data and target India’s youth.

According to the Reliance Retail official, the company is confident that if “there are 10 existing brands, the 11th brand will also get picked up as long as there is value and there is fashion.”

“Shein already has a recall among the youth. It gives us yet another brand in our portfolio through which we can cater to the youth,” the official said.

Shein was built in China on the back of more than 5,400 micro manufacturers — a scattered and loosely organized network of small and midsize factories.

In January this year, on a visit to China, Deka met with manufacturers working for Shein and Temu. On the outskirts of Guangzhou, Deka saw factories set up in areas that appeared residential, with “women sitting inside houses” making clothes.

“The tech is built in a way that somebody sitting there is able to see that, okay, next 15 days or next one month, how much I should be making … that is the kind of integration they have done,” Deka said.

Deka told Rest of World this model is easier to replicate at a smaller scale. “Me, coming from [the] supply chain industry, I understand that it is much easier for a brand like us because we are at a very smaller scale. We can still go to those people, we can still build it in a very unorganized way and then pull it off,” she said. Her company’s annual net revenue is 750 million Indian rupees ($8.6 million).

“[But] somebody like Reliance, they just cannot go haphazard here. … It has to be always organized,” Deka said.

Shein moved its headquarters to Singapore sometime between late 2021 and early 2022, a strategic departure to distance itself from its Chinese origins and facilitate hassle-free international expansion amid the U.S.-China trade war.

India is part of Shein’s wider strategy to diversify its supply chain — one that also includes a newly leased warehouse near Ho Chi Minh City in Vietnam, and efforts to establish alternative manufacturing hubs in Brazil and Turkey.

But in India, Reliance needs Shein as much as Shein needs Reliance for its global pivot. According to Bloomberg, Reliance Retail is focusing on creating leaner operations to weather a wider consumption slump in the Indian economy.

“It remains to be seen whether the Reliance-Shein combine can deliver on the brand’s promise with a wide range of products, fast and on-trend,” Dutta said. “In the years that Shein has been absent, the Indian market has evolved further, competition has intensified, and past goodwill is not enough to provide sales momentum.”

Kunal Purohit is a freelance journalist based in Mumbai, India.

Ananya Bhattacharya is a reporter for Rest of World covering South Asia’s tech scene. She is based in Mumbai, India.

(Published in Rest of World)

admin

March 7, 2025

Shailja Tiwari, Financial Express

March 7, 2025

This is what happens when you hit the gym after a long pause. On your first rebound day, the same weights seem heavier, the same set of squats tires you quicker. You might feel frustrated – nothing seems the way you left it.

The same scenario faces brands looking to make a comeback. Those “muscles” – read brand loyalty -have lost strength due to long absence. The brand’s “stamina”- customer loyalty – have declined with neglect. All of which essentially means you need a relook at the entire “regimen” – the product, price, place and promotion – that seemed to work the last time around.

Men’s fashion brand Reid & Taylor is facing the same dilemma.

Launched in India in 1998, the brand vanished from the market in 2018 after S Kumars – which held the rights to manufacture and market the Scottish brand in India went bankrupt. Reid & Taylor is making a gradual comeback now, under the aegis of its new owner Finquest Group, complete with a campaign featuring new brand ambassador Vicky Kaushal and tagline, “Man on a Mission”.

Finquest Group has invested over ₹750 crore in revitalising the brand. Reid & Taylor is available in more than 1,200 multi-brand and exclusive brand outlets across the country, as per a company announcement.

In January, Reid & Taylor also announced its partnership with the Unicommerce to knit together the brand’s website, warehouses, physical stores, and other online platforms in one integrated network. The tech integration followed the launch of Reid & Taylor’s brand website and its growing presence across various online marketplaces, a clear signal the company is gearing up to address the needs of today’s customer and give its competitors a run for their money.

Kapil Makhija, CEO and MD, Unicommerce, explains how this will enable Reid & Taylor to modernise its operations: “In addition to a consistent customer experience, this integration enables efficient inventory management through a centralised platform that allows ship-from-store service, where the brand can switch orders between warehouses and stores, offering a broader assortment for sale and faster order fulfilment. It also helps Reid and Taylor connect with the more online savvy audience.”

The Indian menswear market, encompassing formal, casual and traditional apparel, had crossed ₹2 trillion in 2023 and is expected to reach ₹4.3 trillion by 2027, as per a Statista report. Experts say that the menswear category has grown exponentially since Reid & Taylor’s first outing. It has a host of local and international brands such as Raymond, Mufti, Allen Solly, Louis Phillipe and Manyavar offering stiff competition.

In other words, Reid & Taylor has its task cut out.

Makeover strategy

The greatest challenge for the relaunched brand is to establish relevance and share-of-mind with a new set of consumers, observes Devangshu Dutta, CEO of Third Eyesight. “In its initial avatar in India, it rode on the brand’s past goodwill, but since its fall a few years ago, the market has changed significantly. Ready-to-wear apparel, growth of modern retail, online commerce and a set of consumers who have no past history or association with the brand are all significant factors at play, remarks Dutta.

At its best in the early-2000s, the brand was positioned mostly within the wedding segment, a category that is also rapidly changing. The styles that dominate wedding apparel are changing among younger cohorts, points out Ajimon Francis, MD India for Brand Finance. Formal three-piece suits and safari suits are no longer style statements.

Consumers are opting either for designer wear like a Tarun Tahiliani or for mid-segment offerings where brands like Raymond operate. “Formal suits are becoming an ‘uncle’ or ‘dadaji’ segment, and the wedding lines showcased by most brands are geared towards traditional wear. Formalwear for weddings now includes sherwanis and kurtas, where brands like Manyavar and FabIndia rule,” he points out.

Reflecting on the brand’s exit earlier from the Indian market, Francis says that its owners’ (S Kumars) inability to adapt the brand to changing consumer behaviour led to its downfall. The Finquest Group will need to clearly redefine its new positioning since Reid & Taylor now offers a mix of styles across casual and formal menswear.

Legacy brings credibility but it can also be baggage, remarks Rutu Mody Kamdar, founder of Jigsaw Brand Consultants. The challenge for Reid & Taylor lies in shaking off the heritage brand’ tag and making itself relevant to younger buyers who value modern style over nostalgia. “It needs to own the ‘quiet luxury’ space, timeless tailoring with a contemporary edge. That includes modern cuts, cultural collaborations, omnichannel presence, and aspirational storytelling,” suggests Kamdar.

E-commerce strategy will be key too. The brand will need to blend strong visuals with smart pricing and seamless strategy. Kamdar adds that Reid & Taylor needs to look at e-commerce as not just a sales channel but also a brand building platform.

(Published in Financial Express – Brandwagon)

admin

December 14, 2024

Sagar Malviya, Economic Times

Mumbai, 14 December 2024

Fast fashion was on a slow lane in the last fiscal year. Sales growth slowed for top retailers and fast fashion brands, show the latest regulatory filings of Marks & Spencer, Zara, H&M, Levi’s, Lifestyle, Uniqlo, Benetton and Celio. The bottom line too had taken a hit, with most brands posting lower profits in the fiscal year ended March 31. Sales growth of H&M and Zara fell from 40% in FY23 to 11% and 8% in FY24, show the filings with the Registrar of Companies. Levi’s growth slowed to 4% from 54% in FY23, while that of Uniqlo halved to 31% from 60%.

The current year is not looking good either, as sticky inflation and stagnant income weigh on consumer spending on discretionary products, say experts.

Devangshu Dutta, founder of retail consulting firm Third Eyesight, said the job market has been under pressure and slower income growth for urban consumer impacted demand, a trend likely to continue even during FY25.

“There is a visible slowdown led by the urban middle class who buy branded products. These brands have been targeting young upwardly mobile consumers, who are tightening the purse strings due to the current economic circumstances of hiring slack and fewer jobs,” said Dutta. “The situation is not hunky-dory at all, and this will continue over the next few quarters.”

Being the world’s most populous country, India is an attractive market for apparel brands, especially with youngsters increasingly embracing western-style clothing. But most international and premium brands have been competing for a relatively narrow slice of the population pie in large urban centres.

Over the past few years, top global apparel and fast fashion brands struck a strong chord with young customers, racking up sales growth of between 40% and 60% in FY23, bucking the trend in a market where the overall demand for discretionary products started slowing down. This has reversed now.

Consumers started reducing non-essential spending, such as on apparel, lifestyle products, electronics and dining out since early last year due to high inflation, increase in interest rates, job losses in sectors like startups and IT, and an overall slowdown in the economy.

According to the Retailers Association of India (RAI), sales growth in organised retail segments such as apparel, footwear, beauty and quick service restaurants halved to 9% last year and slowed further to about 5% in the first six months in the current fiscal year. This slowdown came after a surge in spending across segments-from clothes to cars-in the post-pandemic period, triggered by revenge shopping.

“The base post-pandemic was extremely high, and that kind of growth is not sustainable as there is nothing spectacular in economy to drive demand,” said Kumar Rajagopalan, chief executive officer at the RAI that represents organised retailers. “Our bet was on the festive and wedding season, but we will have to wait and watch until next year for the performance numbers,” he said.

(Published in Economic Times)