admin

January 15, 2026

Sagar Malviya, ET Bureau

Mumbai, 15 January 2026

It’s mostly a tale of two halves for top western fashion labels in India after the runaway sales and retail expansion in the years soon after the pandemic.

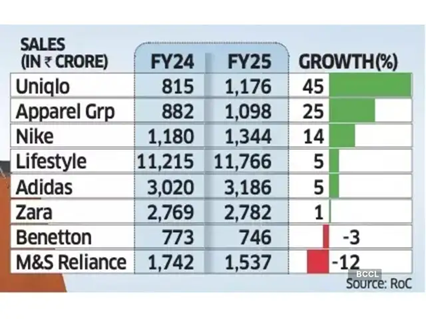

While Marks & Spencer, Benetton, and Adidas are battling waning demand, Uniqlo and Nike are gaining fresh ground, reflecting wider choices and increasingly discerning buyers in one of the world’s fastest-growing consumer economies.

Spanish brand Zara is facing stagnant growth while it tapered off at Apparel Group, which sells Aldo, and Charles & Keith brands in India. Experts termed the divergent sales performance as a potential structural shift instead of demand slowdown in India’s fashion and lifestyle market.

Devangshu Dutta, founder of retail consulting firm Third Eyesight, said consumers have clearly shifted towards function, even as trend-led brands continue to exist though they tend to be comparatively smaller. Some brands are also finding it harder to set or even follow trends the way they once did.

“This is especially true for Gen Z, which stays closely tuned to global trends and acts as the primary driver of fashion adoption,” said Dutta. “While older consumers may have greater spending power in absolute terms, it is younger shoppers who shape trends and influence product sales.”

Growth slowed across most leading retailers and fast-fashion brands in the country in FY24 as high inflation and stagnant incomes crimped discretionary spending.

While the trend remained the same for many even in FY25, select brands staged a strong rebound. For instance, Nike India’s sales rose 14% in FY25, up from a 4% increase in the previous year, while Uniqlo accelerated growth to 45%, from 31% in FY24.

Revival after Festive Season

Even Lifestyle, India’s biggest department store chain, grew 5% last fiscal, rebounding from a 4% decline in FY24.

Uniqlo said it continues to see steady momentum in India, supported by strong customer response, retail expansion, rising brand awareness, and a strong ecommerce uplift. “India is now among Uniqlo’s fastest-growing markets in Asia and plays a meaningful role in the region’s overall business,” Kenji Inoue, chief financial officer and chief operating officer, Uniqlo India told ET. “The country’s young demographic, growing focus on quality, and increasing appreciation for functional everyday clothing have all contributed to this progress.”

According to the Retailers Association of India (RAI), sales growth in organised retail segments such as apparel, footwear, beauty and quick service restaurants (QSR) saw single-digit sales growth last fiscal year but the market has recovered after the festive season with double-digit sales performance.

“Demand has improved, but it isn’t broad-based,” said Kumar Rajagopalan, chief executive at RAI which represents organised retailers. “With more fashion options available, Indian consumers are becoming more selective, and growth is coming to brands that offer a strong value proposition and not the cheapest products, but those where prices are justified by innovation, design and quality.”

In FY25, Apparel Group recorded a 25% sales growth, slowing from a 37% increase a year ago. Inditex Trent, which sells Zara in India, saw flat sales compared with an 8% growth in FY24.

Adidas too saw its revenue growth rate slowing to 5% from 20% in the previous fiscal. Sales of M&S and Benetton fell 12% and 3% each, respectively.

Being the world’s most populous nation, India is an attractive market for apparel brands, especially with youngsters increasingly embracing western-style clothing. However, most international and premium brands have been competing for a relatively narrow slice of the sales pie in large urban centres.

(Published in Economic Times)

admin

December 1, 2025

Priyamvada C, Mint

1 Dec 2025

A wave of investor capital is flowing into India’s laboratory-grown diamond (LGD) segment, as fastscaling brands tap rising consumer adoption in a market now worth well over $300 million. New-age brands have raised multiple rounds of capital on the back of growing market share and improving margins.

Actor Shilpa Shetty-backed Limelight, which is in talks to raise its second round of capital this year, joins the growing list of other small brands such as Onya, Giva, Jewelbox, Lucira Jewellery and Aukera, among others, who have snagged monies in recent months. Limelight has appointed Ambit Capital to raise about $20 million to fund its expansion plans, two people familiar with the matter said.

Confirming the fundraise, the six year-old company’s co-founder Pooja Madhavan said the funds will be used towards store expansion and brand building as it looks to touch 100 stores over the next year. “We are in final talks with growth PE funds and reputed family offices (for the fundraise),” she told Mint.

Other similar fundraises include Onya’s ₹5.5 crore in a pre-seed round led by Zeropearl VC last week, Aukera’s $15 million raise led by Peak XV Partners and Aditya Birla Ventures-backed Giva raised ₹530 crore in an internal round led by Premji Invest, Epiq Capital and Edelweiss Discovery Fund, as it looks to scale up its lab-grown diamond offerings.

Nine pure-play lab grown diamond startups collectively raised a record $26.4 million in 2025, compared with $4.7 million across eight startups last year, data from market intelligence provider Tracxn showed.

The development comes as India’s lab-grown diamond jewellery market, valued at about $300-350 million in 2024, expects to grow at a compound annual growth rate (CAGR) of 15% over the next decade, as per consultancy firm Redseer’s estimates. As the market evolves, several prominent jewellery brands will gradually pivot from exclusively natural/mined diamonds in favour of lab-grown alternatives, alongside high-end jewellers incorporating the lab-growns into their select collections, which will drive sales volumes and act as an affordable entry point for consumers.

This segment has particularly picked pace in the last five years, with millennials and gen Z leading this shift, driven by better value, trendier designs from new-age brands, and growing comfort with lab-grown diamonds as a certified, high-quality product. This category has also widened beyond occasional fashion to gifting, daily wear and increasingly bridal, reflecting sustained consumer confidence and a willingness to treat them as a mainstream jewellery option, Rohan Agarwal, partner at Redseer told Mint in an emailed statement.

He further added that new-age brands have steadily gained market share in the mid-ticket gifting and daily wear segment with many trying to push into premium ranges. While the competitive landscape is still evolving, incumbents have already started responding by launching LGD lines of their own, although the extent to which they can challenge remains to be seen.

Major Indian brands that are considering a foray into this category include Malabar Gold & Diamonds, Senco Gold, which has launched the subbrand Sennes and Tata’s Trent, which launched its brand Pome in Westside stores.

Devangshu Dutta, founder and chief executive officer at Delhi-based consulting firm Third Eyesight, echoed the sentiment. He explained that new-age lab grown diamond players are forcing traditional jewellers to introduce LGD options or risk losing younger customers. “Not just precious jewellery brands, even those that started as fashion jewellery are expanding their range with LGD designs.”

“Down the road, there is potentially scope for consolidation as investors tend to prefer a handful of scaled platforms with strong brand recall and robust economics. So, as the category matures, there may be strategic acquisitions by large jewellery houses and corporates, as well as mergers among funded startups,” he added.

Those startups that can combine in-house manufacturing, design capabilities and data-driven retail expansion would be at an advantage, Dutta said. “Key future growth areas for LGD startups include omnichannel retail presence within India, with offline stores especially in demand-dense locations such as the metros and Tier 1 cities, export markets both with potential cost advantages and brand expansion, and extending into fashion jewellery, everyday wear, coloured lab grown stones and even luxury collaborations that position lab grown as aspirational rather than merely budget friendly.”

(Published in Mint)

admin

April 15, 2024

Sagar Malviya, Economic Times

Mumbai, 15 April 2024

Spanish fashion company Inditex said it will launch youth clothing brand Bershka and Zara Home in India this year.

“Bershka will open its first store in Mumbai Palladium, and Zara Home will open in Bangalore,” it said in its latest annual report.

Inditex had launched fast fashion brand Zara in 2010 and premium clothing brand Massimo Dutti eight years ago. Its new offering, Bershka, will pitch it directly against Reliance Retail’s Yousta, which too targets the younger consumer segment.

Being the world’s second most-populous country, India is an attractive market for apparel brands, especially with youngsters increasingly embracing Western-style clothing. Fast fashion brands such as Zara and H&M became runaway successes soon after they entered the country.

Experts said Bershka’s target consumer profile is mostly teens to mid-20s, slightly younger than that of Zara, which is pitched at 20-40-year-old fashion-driven customers.

“The product assortment is different, with a higher share of knits, fewer dresses and more casual overall compared to Zara, keeping in line with the lifestyles of the customer group. So in that sense it wouldn’t cannibalise Zara in any serious way, though some of the younger set among Zara buyers could migrate some of their purchases to Bershka,” said Devangshu Dutta, founder of retail consulting firm Third Eyesight. “The biggest question is, can they hit the price points that young Indian fashion consumers want as with domestic brands such as Zudio, Yousta and others, or will consumers overlook higher prices for the style mix and a European brand pull in significant numbers to make the brand viable.”

According to a recent report by Motilal Oswal, the ₹2.5 lakh crore value fashion segment accounts for 57% of the total apparel market and is one of the largest and fastest-growing segments. A substantial untapped opportunity beyond the metros and tier-1 cities, driven by better demographics, higher incomes and greater customer aspiration, has compelled several big players to enter a market that was previously dominated by regional and local operators.

Since its inception in 2016-17, Zudio has seen considerable expansion and reached nearly 400 standalone stores, outpacing most apparel brands primarily due to its competitively priced products with an average selling price of ₹300. Following the success of Zudio, a unit of the Tata Group’s Trent, the segment has seen the entry of national retailers in the affordable youth clothing segment such as Yousta by Reliance Retail, Style-Up by Aditya Birla Fashion and Retail and Shoppers Stop’s InTune.

(Published in Economic Times)

Devangshu Dutta

September 4, 2010

The last three years have been a roller coaster ride for food & grocery modern retail in India.

Progressive Grocer’s India edition was launched in September 2007, during what was an excellent series of years for the modern retail trade in the country.

It was a year after the launch of Reliance Fresh, and a few months after the acquisition of Trinethra’s chain of 170 stores by the traditionally conservative Aditya Birla Group. Spencer’s announced its plans to raise capital for expansion, while Food Bazaar together with its value-format non-food twin Big Bazaar already accounted for more than half the Future Group’s sales.

Other than the established corporate groups, new entrants such as Wadhawan were also well into growth through mergers and acquisitions, including their purchase of Sangam, Hindustan Unilever’s experiment at retailing directly to consumers, Sabka Bazaar and The Home Store.

The four largest foreign retailers were also making their presence felt through Walmart’s announcement of a joint-venture with Bharti in August, Tesco’s and Carrefour’s intensive investigations of the market and negotiations with potential partners, and Metro’s announcement of its planned growth to 100 outlets.

The modern retail engine seemed to be chugging along strongly. But there were also spots of trouble in paradise.

Protests against the opening of corporate chain stores were seen in a few states. In some cases state administrations even formally stepped in to ask for closure of corporate chains to avoid civic trouble, and it looked as if the lights were going out even before the party had really started!

Along with the battle between modern and traditional, both sides of the debate on foreign direct investment (FDI) into the Indian retail sector were also ramping up their arguments. There was vocal opposition from emerging large Indian retailers, as well as the small traders group, while investors and some of the prominent retailers championed the cause of foreign investment.

In both debates, international examples of the damage wrought by large or foreign retailers to local economies were quoted by those opposed to corporate retailers. And in both, the developmental aspects of modern retail were quoted by proponents of modern retail and FDI.

At Third Eyesight, in early 2007 we had carried out a study (“From Ripples to Waves”) on the increasing impact of modern retail on the supply chain. Amongst the study’s respondents, both retailers and suppliers had favourable things to say about the growth of modern retail and its impact on the supply chains for various products. There was not just talk of efficiency with fewer layers of transactions and lower costs, but also of effectiveness, with suppliers reporting 10-25% higher per square foot sales in modern retail stores as compared to their displays in traditional independent stores.

After years of resisting the impending changes to their ordering and servicing structures, major Indian FMCG and food brands became busy setting up or strengthening teams focussed on the modern trade or ‘organised’ corporate customers.

The market was rich with format experimentation for food and general merchandise retail, typically between 1,000 sq ft and 10,000 sq ft, but also with a gradual growing emphasis on 20,000-80,000 sq ft supermarkets and hypermarkets.

Literally hundreds of food brands from other countries actively sought to tap into the growing Indian market, and modern retailers offered them a familiar environment and a well-managed platform for launch.

At the same time, plenty of respondents also said that they had not made any significant changes to their business. Either inertia or fear of channel conflict was preventing them from pushing ahead with newer business models.

In short, there was no dearth of action and contradiction, no matter where you looked.

However, towards the end of 2007 and beginning of 2008, we had a sense of foreboding. With the rush to expand the store network to get first to some yet-invisible finish line, both property acquisition and human resource costs were driven up by a feeling of a shortage in both. I recall writing a column around that time, urging retailers to look at store productivity as their first priority (See: Priority #1: Store Productivity, Same Store Growth).

By the middle of 2008 the crisis was evident. There was a lot of square footage, much of it in the wrong places. There were issues with the supply chain for managing fresh and perishables, those very products that drive frequent footfall into a food store. More importantly, the global financial storm had started gathering strength, reducing liquidity in the market and making investors and lenders look more closely at existing business models.

The spectacular meltdown of Subhiksha in 2008, and the more gradual but equally deep impact on other businesses was visible. And worrying. Players as disparate as Reliance, with its ambitious plans to grow into a Rs. 300 billion retail juggernaut, and the Shopper’s Stop premium format Hypercity seem to take a break to rethink.

2008 and 2009 were years that I am sure many retailers would like to forget, but they were also very valuable. Some people have compared these years to the churning of the ocean (manthan) by the devas and the asuras in Indian mythology, with the deadly poison halahal coming to the surface before the divine nectar amrit could be reached.

In these two years, we have seen stores closed, formats changed, and organisations made slimmer. Store staff have discovered how to live with small changes like higher ambient air-conditioning temperatures, and are learning the more important science of higher transaction values, even with leaner inventories. Management teams are becoming more accustomed to looking at retail metrics other than only sales growth that could be achieved from new square footage. Vendors are finding newer ways to make their brands more relevant to consumers and to the retailers.

More importantly, these years have also underlined the importance of India as a growth market to non-Indian companies.

2010 so far seems a far happier year. Income and GDP growth figures look much healthier. Real estate inventories in malls that were not released in 2007-2009 are coming on the market, many at terms that are more favourable than earlier. Retailers’ financial results look healthier.

There could always be the temptation to rush headlong into growth again. But I don’t think food retailers or their vendors should drop their guard yet.

The coming months and years need significant sharpening up of customer insight, merchandise and inventory planning capabilities and supply chains. Operational assessments, analytics, organisational capability building, are all tools which will need to be looked at closely.

We are at the cusp of the next growth curve, as the population grows and matures, and the market become more sophisticated.

Though the large-small, local-foreign debate isn’t closed yet, the much-awaited approval from the government to allow foreign investment into multi-brand retail businesses may be around the corner.

Even if FDI doesn’t happen immediately, the majors are already in or preparing to enter and ride the consumption growth that will logically happen. In addition to its support to Bharti’s Easyday chain, Walmart has launched its cash and carry operation, Bestprice. Carrefour reportedly is looking to open its first Indian (wholesale) outlet by November in New Delhi on its own, even as rumours of a partnership with the Future Group fly thick and fast. And Tesco is steadily steaming ahead with the Tata group.

And practically every month we are seeing new products and even new brands being launched by Indian and non-Indian companies.

An old saying goes: the journey of a thousand miles begins with a single step.

From the tumultuous events of the last three years, it seems that the Indian food retail sector must have travelled at least a few hundred miles already. In one sense it has. Many of the developments that we’ve seen in three years would have taken at least a couple of decades in the more mature markets.

However, in another sense, the food and grocery modern retail sector in India has only taken the first few steps, with much to be accomplished still. The sector remains fragmented, and wide swathes of the market are yet to be penetrated – not just by modern trade, but even by brands that already supply traditional retail. The blend of players and business models, not to forget the spicy regional mix of different market segments, promises valuable lessons not only for those in India but potentially for other markets in the world.

There are very big questions seeking answers. How to improve agricultural productivity so that food security is ensured. How to save the abundant harvests rather than letting them rot in unprotected storage dumps. How to ensure adequate calories and nutrition get delivered not just to the wealthy and the middle class, but also to the poorest in the country.

On the retail side, the Indian versions of Walmart, Carrefour and Tesco are possibly still in the making, and may yet surprise us with their origins and growth stories. And e-commerce is a work-in-progress that may be the dark horse, or forever the black sheep.

I think the big stories are yet to unfold, and the unfolding will be exciting, whether we are just watching or actively participating in the modernisation of the Indian food retail business.

admin

January 7, 2010

By Tarang Gautam Saxena, Chandni Jain and Neha Singhal

In Retrospect

While India was a promising market to many international brands, it was not completely immune from the global economic flu. More than its primary impact on the economy, the global downturn sobered the mood in the consumer market. Even the core target group for international brands, that had just begun to splurge apparently without guilt, tightened their purse strings and either down-traded or postponed their purchases.

In 2008 in the midst of economic downturn, skepticism and uncertainty, the international fashion brands had continued to enter India at nearly the same momentum as the previous year. Many international brands such as Cartier, Giorgio Armani, Kenzo and Prada entered India in 2008 targeting the luxury or premium segment. However, given the high import duties and high real estate costs, the products ended up being priced significantly higher than in other markets. Many players ended up discounting the goods heavily to promote sales while a few also gave up and closed shop.

As the Third Eyesight team had foreseen last year, 2009 saw a further slowdown and fewer international brands being launched during the year. The brands that were launched in 2009 included Beverly Hills Polo Club, Fruit of the Loom, Izod, Polo U.S., Mustang, Tie Rack and Timberland. Some of these had already been in the pipeline for quite some time and invested a considerable time and effort in understanding the dynamics of the Indian retail market, scouting for appropriate partners, building distribution relationships and tying up for retail space, setting up the supply chain and, most importantly, getting their operational team in place.

International Fashion Brands in India

After many deliberations, the well-known global brand Donna Karan New York set foot in the Indian market in 2009 through an agreement with DLF Brands to set up exclusive DKNY and DKNY Jeans stores India. The brand is also reported to have signed a worldwide licensing agreement with S Kumars Nationwide Ltd to design, manufacture and retail DKNY menswear in certain specific countries.

Second Chances

Amongst the international brands that have recently entered the Indian market, a few are on their second or even third attempt at the market.

For instance, Diesel BV initially signed a joint venture agreement in 2007 with Arvind Mills, and the partnership intended opening 15 stores by 2010. However, by the middle of 2008, the relationship ended with mutual consent, as Arvind reduced its emphasis on retailing international brands within the country. Within a few months of the ending of this relationship, Diesel signed a joint venture with Reliance Brands for a launch scheduled for 2010. Both partners seem to be strategically aligned with a common goal as the international iconic denim brand wants to take on the Indian market full throttle and the Indian counterpart has indicated that it wants to rapidly build its portfolio of Indian and foreign brands in the premium to luxury segments across apparel, footwear and lifestyle segments.

Similarly, Miss Sixty entered India in 2007 through a franchisee agreement with Indus Clothing. It switched to a joint venture with Reliance Brands in the same year but the partnership was called off in 2008, despite plans to open more than 50 stores in the first three years of operations. Miss Sixty has finally entered India through a franchise agreement with a manufacturer of women’s footwear and accessories. The company has currently introduced only shoes and accessories category and is looking at potential partners for its label Energie and girls’ range Killah.

Other brands that have re-entered the Indian market include Germany-based Lerros whose first presence in India was back in mid-1990s. The brand re-entered the market in 2008 through own brand stores and is growing its presence through this route as well as through multi-brand stores.

Oshkosh B’gosh is another brand that had entered India in mid 1990s, through a licensing agreement with Delhi based buying house, Elanco. The licensee found the childrenswear market hard to crack, and closed down. In 2008, Oshkosh re-entered the Indian market through a licensing partnership with Planet Retail and is now available through shop-in-shop counters at Debenhams stores. Reports suggest that it may consider setting up exclusive brand outlets.

During the turbulence of 2008 and 2009, a few brands also exited the market. Some of them were possibly due to misplaced expectations initially about the size of the market or about the pace of change in consumer buying habits. Others were due to a failure either on the part of the brand or its Indian partners (or both) to fully understand what needed to be done to be successful in the Indian market. Whatever the reason, the principals or their partners in the country decided that the business was under-performing against expectations and for the amount of effort and money being invested, and that it was better to pull the plug.

Some brands that have been pulled out of the Indian market during 2008 and 2009 include Dockers, Gas, Springfield and VNC (Vincci). Gas (Grotto SpA) is reported to remain interested in the market but has not found another partner after its deal with Raymond fell through in 2007 and all dozen of its standalone stores were shut down.

The Scottish brand Pringle and its Indian licensee did not renew their agreement upon its expiry. The Indian partner has reportedly signed an agreement to launch another international brand in India, while Pringle is said to be looking for new licensee.

The good news is that successful relationships outnumber every exit or break in relationship possibly by a factor of ten. Some of the brands that have sustained are among the early entrants having a presence in India since the late-1980s and 1990s or even earlier. These include Bata, Benetton, adidas, Reebok (now also owned by adidas), Levi Strauss and Pepe. Having grown very aggressively during 2006 and 2007 Reebok quickly became the largest apparel and footwear brand in India, while Benetton and Levi’s are expected to cross the $100-million mark for sales this year.

Entry Strategy & Recent Shifts

As envisaged in Third Eyesight’s report from a year ago, with changing market conditions and a growing confidence in the Indian market, there has been a shift among international brands in the choice of the launch vehicle. While franchising has been the preferred mode of market entry in the recent past for risk-averse brands, more brands today demonstrate a long-term commitment to the Indian market, and are choosing to exercise ownership through wholly or partially owned subsidiaries and through joint ventures.

In 2009, we have seen a noticeable shift in favour of joint-ventures as the choice for entry into the market. Even the brands already present are looking to modify the nature of their existing presence in India in order to exert more control over the retail operations, products, supply chain and marketing.

Current Operating Structure

(End 2009)

Brands that changed their operating structures and, in some cases partners, in recent years include VF (Wrangler, Lee etc.), Lee Cooper, Lee, and Louis Vuitton amongst others.

Mothercare, the baby product retailer, which is present through a franchise agreement with Shopper’s Stop has, in addition, recently formed a joint venture with DLF Brands Ltd to enable the expansion through stand-alone stores. Gucci, which had initially entered in 2006 with the Murjani Group as a franchisee, has recently changed over to Luxury Goods Retail, and is now in the process of restructuring the relationship into a joint venture.

VF has also been reported to be looking to license Nautica, Jansport and Kipling to a new partner. Until now, these brands were handled through the joint venture with Arvind Brands. Arvind has increasingly focused on its core business, closed stores and scaled down expansion plans for the international brands.

Burberry that had entered India in 2006 through a franchisee arrangement with Media Star opened two stores under this arrangement. It has now set up a new joint venture with Genesis Colors and plans to open 20 stores across the country.

More recently Esprit has also been reported to have approached Aditya Birla Nuvo to deepen its engagement by moving from its distribution arrangement into joint venture as the international brand sees excellent potential in the Indian market.

Buckling up for 2010

Throughout 2009, the one fact that became clear was that the Indian market was resilient. Now, as the global economic condition stabilizes, confidence levels of brands and retailers in India have also improved.

Several launches are already expected in 2010, and possibly many more are being worked upon. In the following 12 months, consumers can expect to find within India acclaimed brands such as Diesel, Topman, Topshop and the much-anticipated Zara. Many more Italian, British and French brands are examining the market.

Most of the international fashion brands already present in the market are also projecting a cautiously upbeat outlook in their plans, while a few are looking positively bullish.

For example, Pepe, an old player in premium and casual wear segment, has reported plans to grow its retail network further and open 50 more franchise stores by September 2010. Similarly the German fashion brand S. Oliver that entered the Indian market in 2007 is looking to grow significantly. It has already moved from a franchise arrangement with Orientcraft to a joint-venture with the same partner, and has stepped up its above-the-line marketing presence. The brand has recently reported its plans to scale up its retail presence to 77 stores by the end of 2012 while also strengthening its presence through shop-in-shop in multi-branded outlets in high potential markets.

Those international brands that have tasted success have not achieved it by blindly importing business models and formulas from other markets. Most have had to devise a different positioning from their home markets. Some have significantly corrected pricing and fine-tuned the product offering since they first launched. These include The Body Shop which decreased its prices by up to 30% this year, and Marks & Spencer which reduced prices by 20-40%. Others are unearthing new segments to grow into; for instance, Puma and Lacoste are now seriously targeting womenswear as a growth market.

On the operational side, the good news for retailers and brands is that the average real estate costs have reduced significantly, although marquee locations remain high. In several locations lease models have also moved from only fixed rent to some form of revenue sharing arrangement with the landlord. And, while the sector has seen some employee turmoil as many non-retail executives who came into the business in the last 5-7 years have returned to other sectors, employee salary expectations are also more realistic.

As customer footfall and conversions pick up, international brands are also shoring up their foundations for future expansion in terms of better processes and systems, closer understanding of the market, and nurturing talent within their team. Third Eyesight’s recent work with international brands’ business units in India highlights the international players’ concern with ensuring a consistent brand message, improved organizational capabilities right down to front-line staff, and focus on unit productivity (per store and per employee).

We may yet see a few more exits, and possibly some more relationships being reshuffled and partners being changed. However, all things considered, we can look forward to a net increase in the number of international brands in the country.

The Indian consumer is certainly demonstrating more optimism and as far as there are no major unforeseen global or domestic shocks, this optimism should translate into a healthier business outlook for international brands as well. According to early signs, 2010 could be an excellent curtain-raiser for a new decade of growth for international fashion brands in India.

[The 2009 report is available here: “International Fashion Brands – India Entry Strategies”]

(c) 2010, Third Eyesight

[Note: This report is based on information collected from a combination of public as well as proprietary sources, and in some cases may differ from press reports. However, no confidential information has been shared in this report.]